Question: MRPL is considering two mutually exclusive projects - Project A and Project B. Each requires an initial investment of $300,000. MRPL which has a 13%

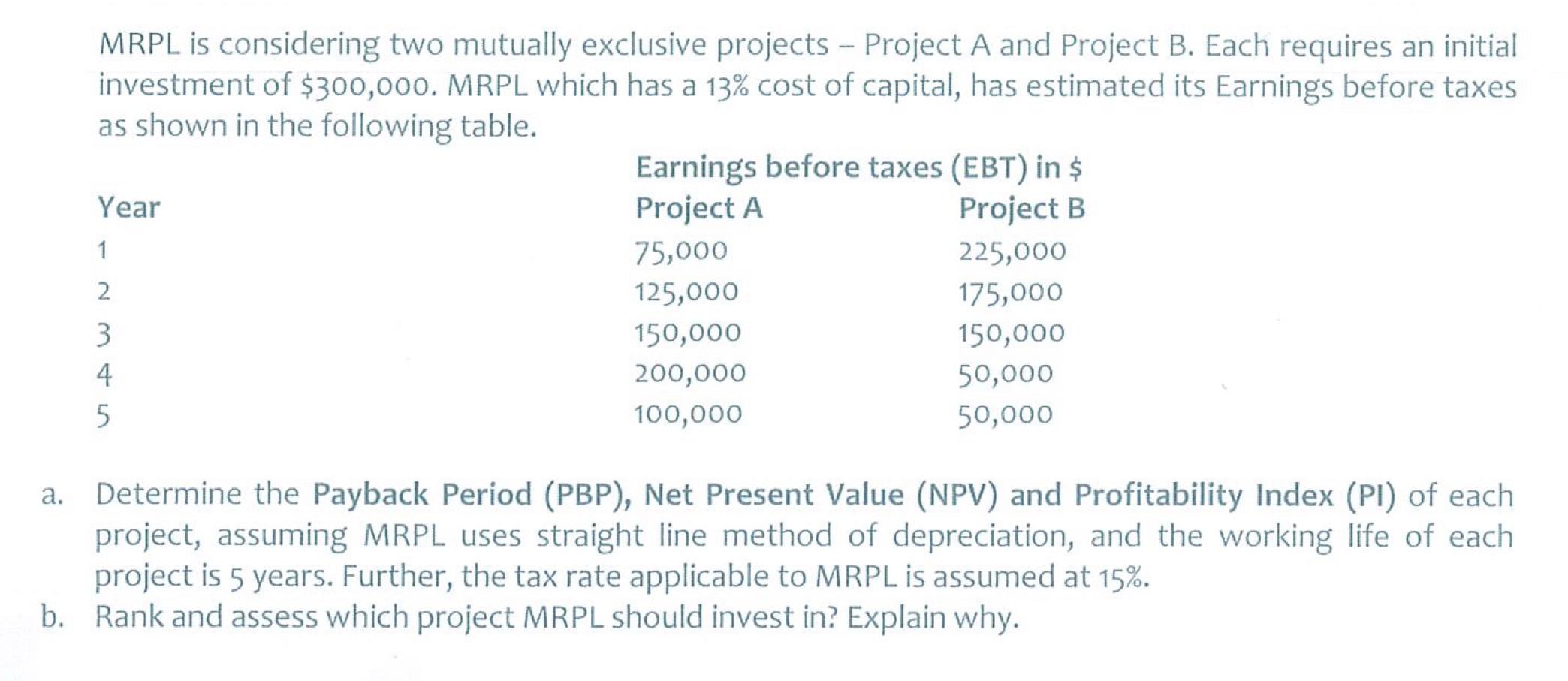

MRPL is considering two mutually exclusive projects - Project A and Project B. Each requires an initial investment of $300,000. MRPL which has a 13% cost of capital, has estimated its Earnings before taxes as shown in the following table. Earnings before taxes (EBT) in $ Year Project A Project B 75,000 225,000 125,000 175,000 3 150,000 150,000 4 200,000 50,000 5 100,000 50,000 1 N a. Determine the Payback Period (PBP), Net Present Value (NPV) and Profitability Index (PI) of each project, assuming MRPL uses straight line method of depreciation, and the working life of each project is 5 years. Further, the tax rate applicable to MRPL is assumed at 15%. b. Rank and assess which project MRPL should invest in? Explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts