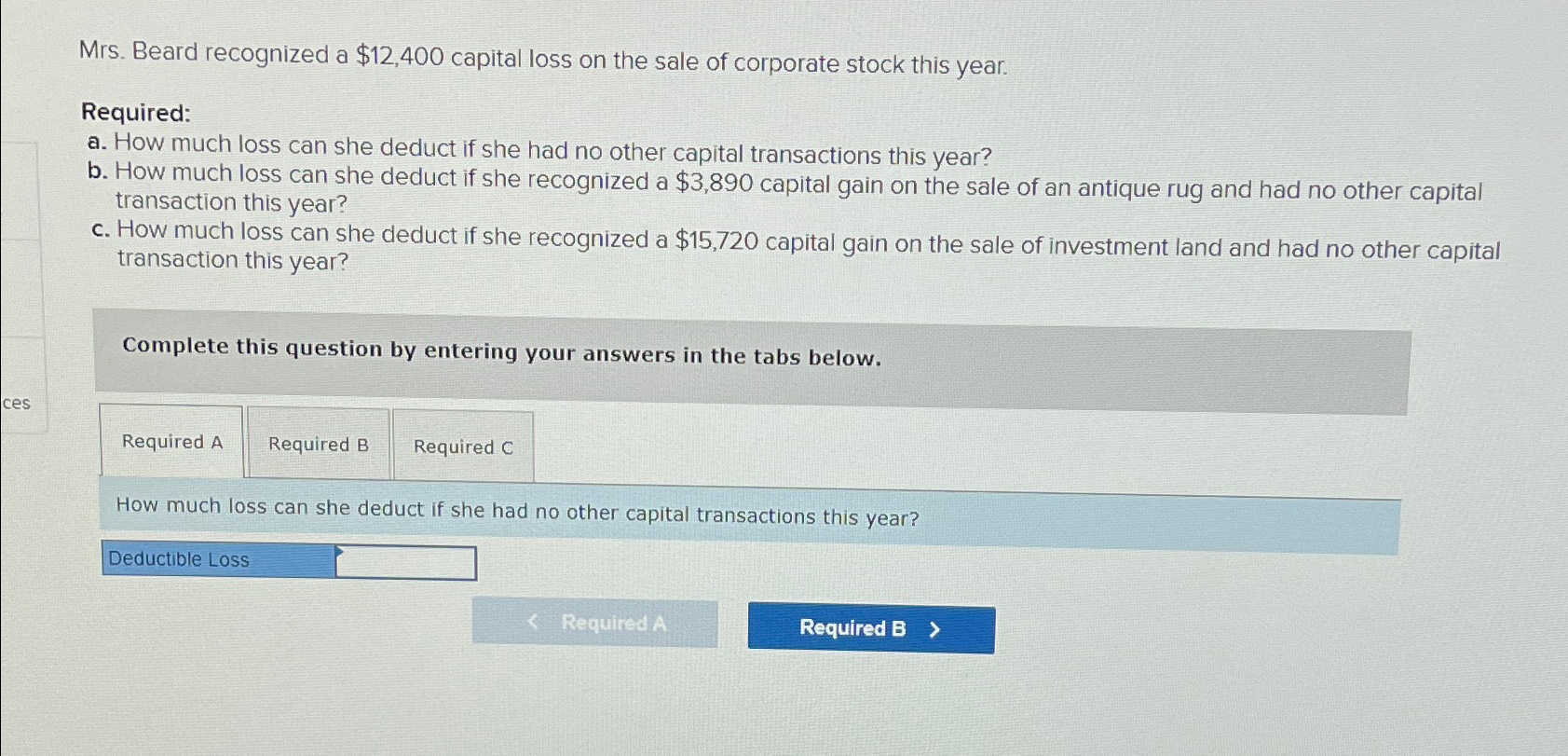

Question: Mrs . Beard recognized a $ 1 2 , 4 0 0 capital loss on the sale of corporate stock this year. Required: a .

Mrs Beard recognized a $ capital loss on the sale of corporate stock this year.

Required:

a How much loss can she deduct if she had no other capital transactions this year?

b How much loss can she deduct if she recognized a $ capital gain on the sale of an antique rug and had no other capital transaction this year?

c How much loss can she deduct if she recognized a $ capital gain on the sale of investment land and had no other capital transaction this year?

Complete this question by entering your answers in the tabs below.

Required B

Required C

How much loss can she deduct if she had no other capital transactions this year?

Deductible Loss

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock