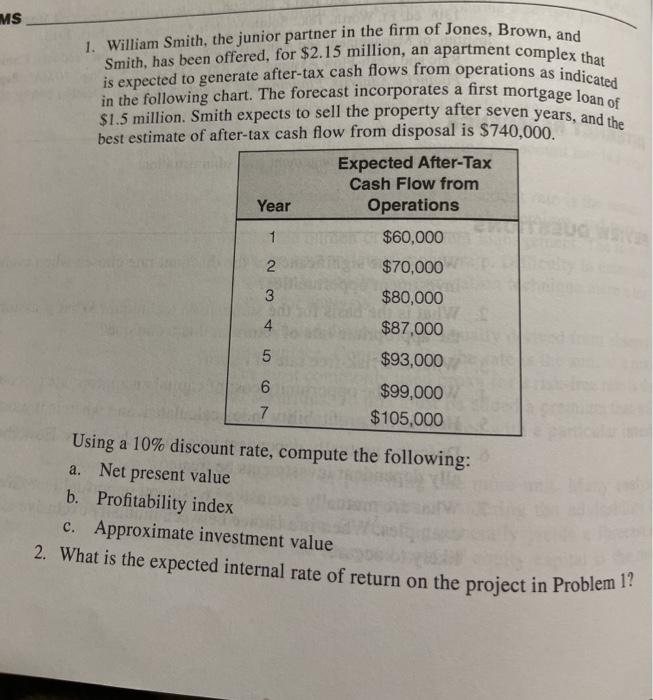

Question: MS 1. William Smith, the junior partner in the form of Jones, Brown, and Smith, has been offered, for $2.15 million, an apartment complex that

MS 1. William Smith, the junior partner in the form of Jones, Brown, and Smith, has been offered, for $2.15 million, an apartment complex that is expected to generate after-tax cash flows from operations as indicated in the following chart. The forecast incorporates a first mortgage loan of $1.5 million. Smith expects to sell the property after seven years, and the best estimate of after-tax cash flow from disposal is $740,000. Expected After-Tax Cash Flow from Year Operations 1 $60,000 2 $70,000 3 $80,000 $87,000 4 $93.000 5 . 7 $99,000 $105,000 Using a 10% discount rate, compute the following: a. Net present value b. Profitability index c. Approximate investment value 2. What is the expected internal rate of return on the project in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts