Question: Ms. Assad wants to know the maximum RRSP contribution she can make in 2019 or in the first 60 days of 2020 that will be

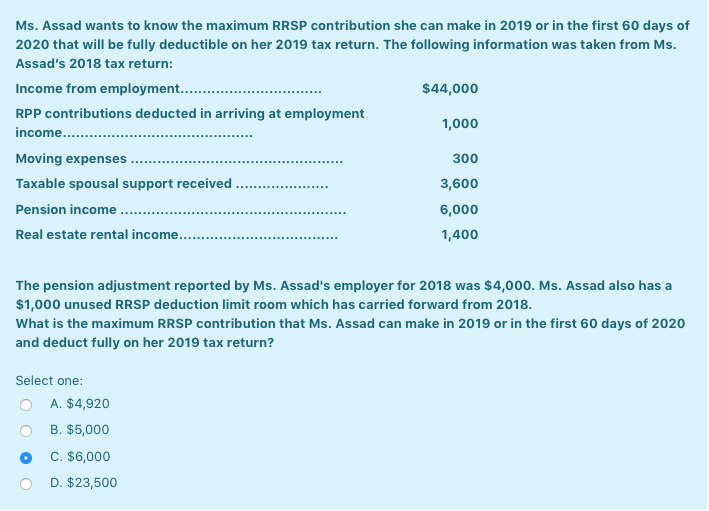

Ms. Assad wants to know the maximum RRSP contribution she can make in 2019 or in the first 60 days of 2020 that will be fully deductible on her 2019 tax return. The following information was taken from Ms. Assad's 2018 tax return: Income from employment... $44,000 RPP contributions deducted in arriving at employment income....... 1,000 Moving expenses 300 Taxable spousal support received 3,600 Pension income 6,000 Real estate rental income...... 1,400 The pension adjustment reported by Ms. Assad's employer for 2018 was $4,000. Ms. Assad also has a $1,000 unused RRSP deduction limit room which has carried forward from 2018. What is the maximum RRSP contribution that Ms. Assad can make in 2019 or in the first 60 days of 2020 and deduct fully on her 2019 tax return? Select one: A. $4,920 B. $5,000 C. $6,000 D. $23,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts