Question: Ms . Hill earned a $ 9 4 , 0 0 0 salary, and Mr . Gomez earned a $ 1 7 5 , 2

Ms Hill earned a $ salary, and Mr Gomez earned a $ salary. Neither individual had any other income, and neither o itemize deductions. Assume the taxable year is Use Individual Tax Rate Schedules and Standard Deduction Table:

Required:

a Compute Mr Gomez and Ms Hill's combined tax if they file as single individuals.

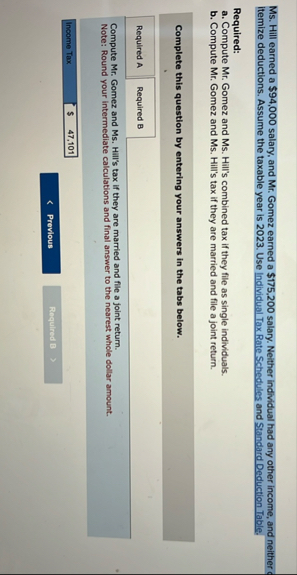

b Compute Mr Gomez and Ms Hill's tax if they are married and file a joint return.

Complete this question by entering your answers in the tabs below.

Required B

Compute Mr Gomez and Ms Hill's tax if they are married and file a joint return.

Note: Round your intermediate calculations and final answer to the nearest whole dollar amount.

tableIncome Tax,$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock