Question: Ms Limi, a nance manager is studying the relationship between stock prices and its price-to-earnings (PE) ratios for her own investment portfolio. Based on a

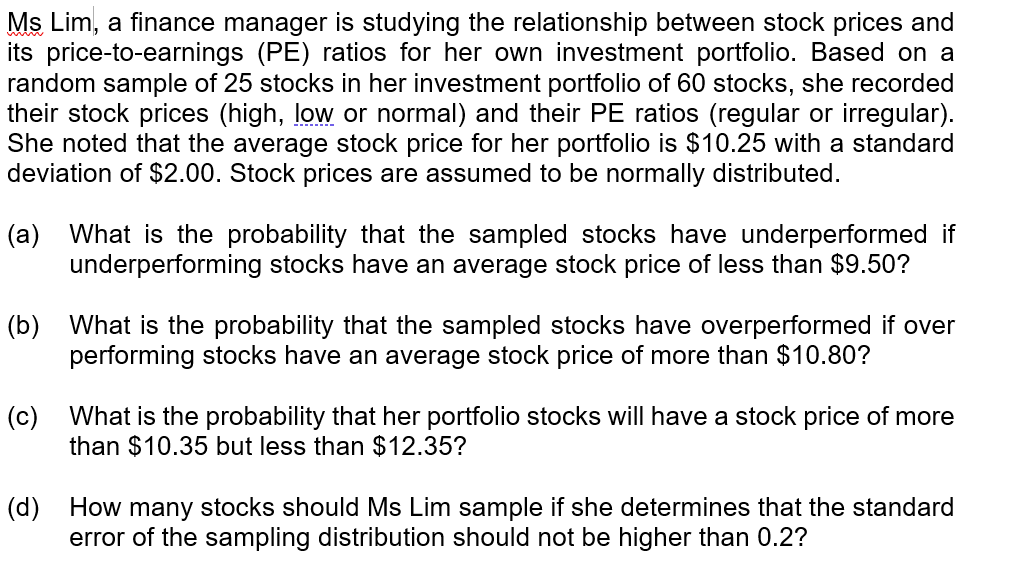

Ms Limi, a nance manager is studying the relationship between stock prices and its price-to-earnings (PE) ratios for her own investment portfolio. Based on a random sample of 25 stocks in her investment portfolio of 60 stocks, she recorded their stock prices (high, ngy or normal) and their PE ratios (regular or irregular). She noted that the average stock price for her portfolio is $10.25 with a standard deviation of $2.00. Stock prices are assumed to be normally distributed. (a) What is the probability that the sampled stocks have underperformed if underperforming stocks have an average stock price of less than $9.50? (b) What is the probability that the sampled stocks have overperformed if over performing stocks have an average stock price of more than $10.80? (c) What is the probability that her portfolio stocks will have a stock price of more than $10.35 but less than $12.35? (d) How many stocks should Ms Lim sample if she determines that the standard error of the sampling distribution should not be higher than 0.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts