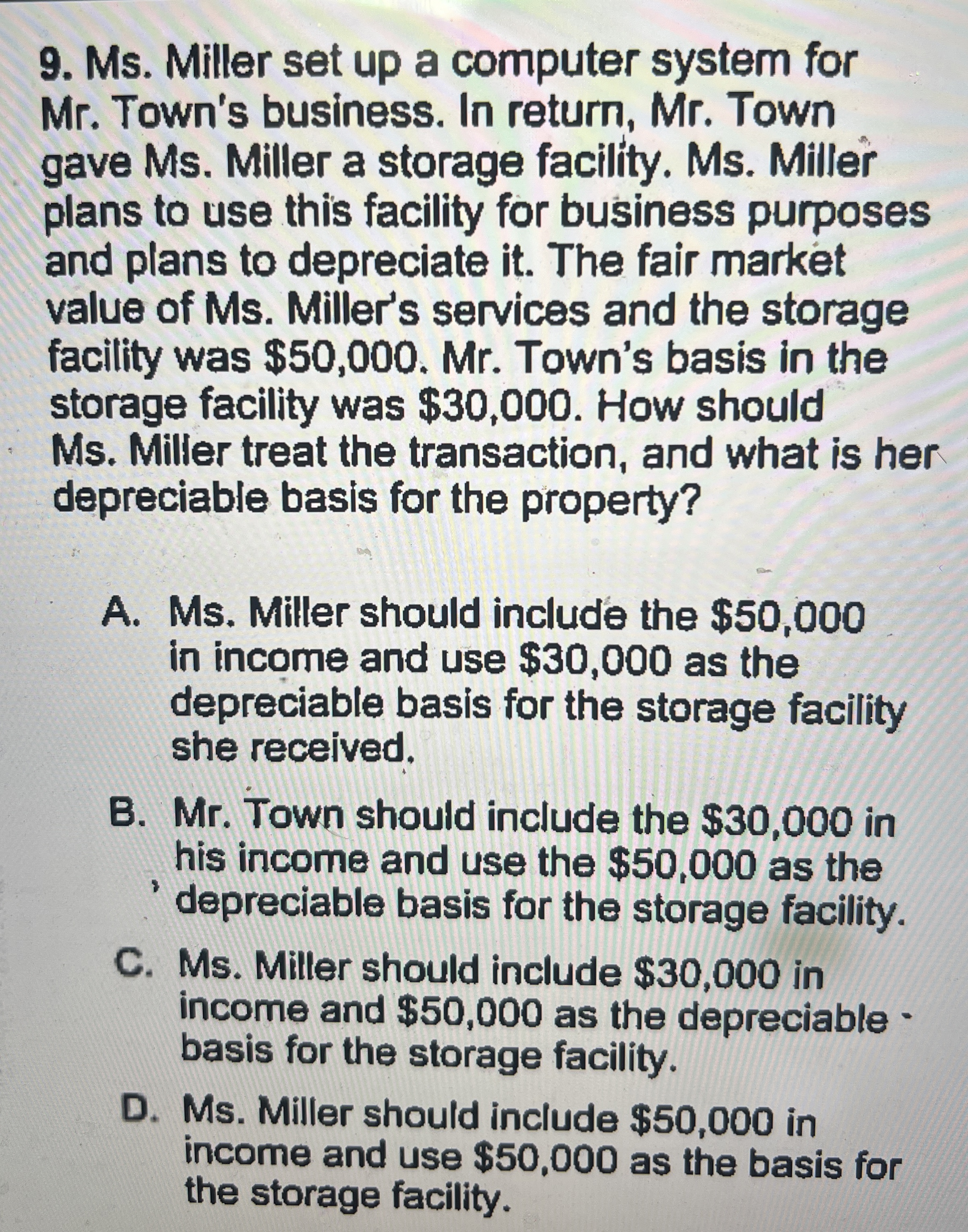

Question: Ms . Miller set up a computer system for Mr . Town's business. In return, Mr . Town gave Ms . Miller a storage facility.

Ms Miller set up a computer system for

Mr Town's business. In return, Mr Town

gave Ms Miller a storage facility. Ms Miller

plans to use this facility for business purposes

and plans to depreciate it The fair market

value of Ms Miller's services and the storage

facility was $ Mr Town's basis in the

storage facility was $ How should

Ms Miller treat the transaction, and what is her

depreciable basis for the property?

A Ms Miller should include the $

in income and use $ as the

depreciable basis for the storage facility

she received.

B Mr Town should include the $ in

his income and use the $ as the

depreciable basis for the storage facility.

C Ms Miller should include $ in

income and $ as the depreciable

basis for the storage facility.

D Ms Miller should include $ in

income and use $ as the basis for

the storage facility.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock