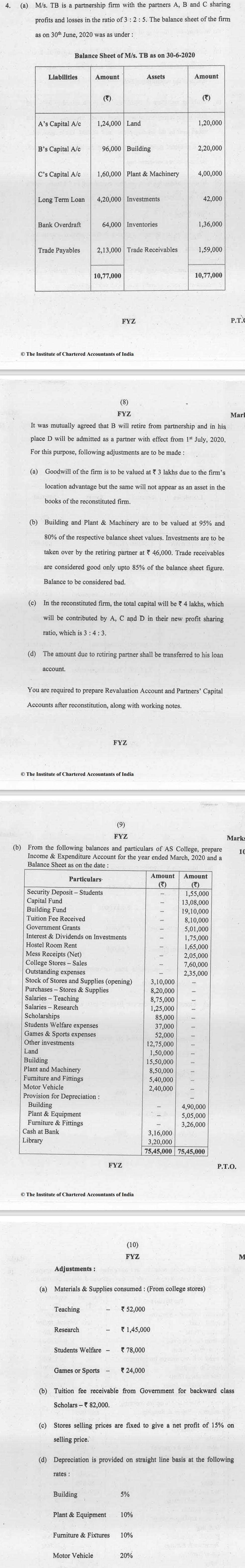

Question: M/s. TB is a partnership firm with the partners A, B and C sharing profits and losses in the ratio of 3: 2:5. The

M/s. TB is a partnership firm with the partners A, B and C sharing profits and losses in the ratio of 3: 2:5. The balance sheet of the firm as on 30th June, 2020 was as under : Liabilities Balance Sheet of M/s. TB as on 30-6-2020 A's Capital A/c B's Capital A/c C's Capital A/c Long Term Loan Bank Overdraft Trade Payables account. Amount 1,24,000 Land The Institute of Chartered Accountants of India 1,60,000 Plant & Machinery 96,000 Building 4,20,000 Investments 10,77,000 Adjustments : Teaching 2,13,000 Trade Receivables Research 64,000 Inventories FYZ The Institute of Chartered Accountants of India rates : It was mutually agreed that B will retire from partnership and in his place D will be admitted as a partner with effect from 1st July, 2020. For this purpose, following adjustments are to be made : (8) FYZ (a) Goodwill of the firm is to be valued at 3 lakhs due to the firm's location advantage but the same will not appear as an asset in the books of the reconstituted firm. Students Welfare Building (b) Building and Plant & Machinery are to be valued at 95% and 80% of the respective balance sheet values. Investments are to be taken over by the retiring partner at 46,000. Trade receivables are considered good only upto 85% of the balance sheet figure. Balance to be considered bad. Games or Sports (c) In the reconstituted firm, the total capital will be 4 lakhs, which will be contributed by A, C and D in their new profit sharing ratio, which is 3:4:3. The Institute of Chartered Accountants of India (d) The amount due to retiring partner shall be transferred to his loan Motor Vehicle You are required to prepare Revaluation Account and Partners' Capital Accounts after reconstitution, along with working notes. FYZ - Assets (9) FYZ (b) From the following balances and particulars of AS College, prepare Income & Expenditure Account for the year ended March, 2020 and a Balance Sheet as on the date : Particulars Security Deposit - Students Capital Fund Building Fund Tuition Fee Received Government Grants Interest & Dividends on Investments Hostel Room Rent Mess Receipts (Net) College Stores - Sales Outstanding expenses Stock of Stores and Supplies (opening) Purchases - Stores & Supplies Salaries - Teaching Salaries Research Scholarships Students Welfare expenses Games & Sports expenses Other investments Land Building Plant and Machinery Furniture and Fittings Motor Vehicle Provision for Depreciation : Building Plant & Equipment Furniture & Fittings Cash at Bank Library FYZ 1 (10) FYZ *52,000 Amount *78,000 1,45,000 24,000 1,20,000 2,20,000 (a) Materials & Supplies consumed: (From college stores) 4,00,000 5% Plant & Equipment 10% 42,000 Amount 3,10,000 8,20,000 8,75,000 1,25,000 85,000 37,000 52,000 12,75,000 1,50,000 15,50,000 8,50,000 5,40,000 2,40,000 Furniture & Fixtures 10% 1,36,000 1,59,000 20% 10,77,000 III Amount 3,16,000 3,20,000 75,45,000 75,45,000 1,55,000 13,08,000 19,10,000 8,10,000 5,01,000 1,75,000 1,65,000 2,05,000 7,60,000 2,35,000 4,90,000 5,05,000 3,26,000 (b) Tuition fee receivable from Government for backward class Scholars - 82,000. (c) Stores selling prices are fixed to give a net profit of 15% on selling price. (d) Depreciation is provided on straight line basis at the following P.T. Marl Marks P.T.O. 10 M

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts