Question: Msunduzi Analytics is evaluating Naspers Inc using the FCFF valuation method. They have collected the following information: Naspers has an EBIT of 250 million, depreciation

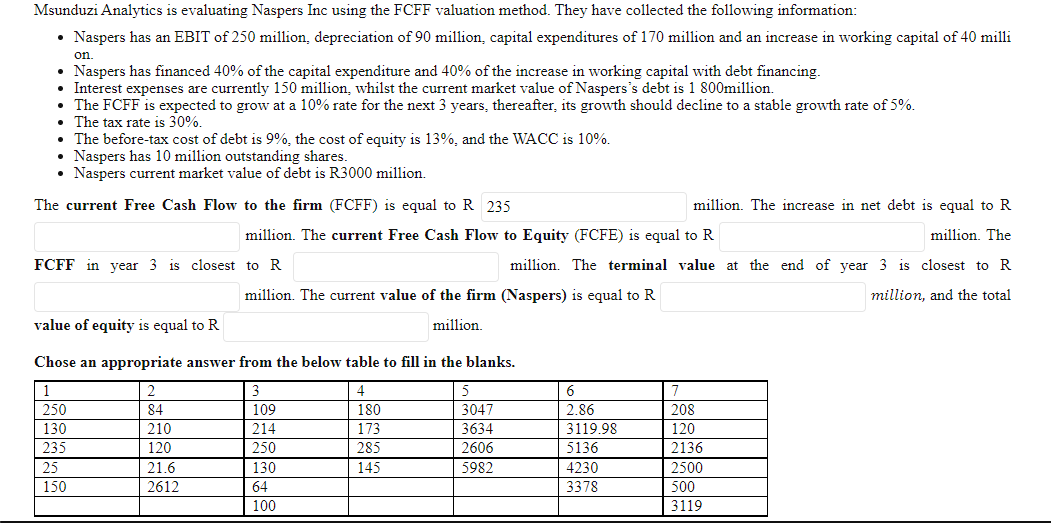

Msunduzi Analytics is evaluating Naspers Inc using the FCFF valuation method. They have collected the following information: Naspers has an EBIT of 250 million, depreciation of 90 million, capital expenditures of 170 million and an increase in working capital of 40 milli on. Naspers has financed 40% of the capital expenditure and 40% of the increase in working capital with debt financing. Interest expenses are currently 150 million, whilst the current market value of Naspers's debt is 1 800million. The FCFF is expected to grow at a 10% rate for the next 3 years, thereafter, its growth should decline to a stable growth rate of 5%. The tax rate is 30%. The before-tax cost of debt is 9%, the cost of equity is 13%, and the WACC is 10%. Naspers has 10 million outstanding shares. Naspers current market value of debt is R3000 million. The current Free Cash Flow to the firm (FCFF) is equal to R 235 million. The increase in net debt is equal to R million. The current Free Cash Flow to Equity (FCFE) is equal to R million. The FCFF in year 3 is closest to R million. The terminal value at the end of year 3 is closest to R million. The current value of the firm (Naspers) is equal to R million, and the total value of equity is equal to R million. Chose an appropriate answer from the below table to fill in the blanks. 1 2 3 4 5 6 7 250 84 109 180 3047 208 130 210 214 173 2.86 3119.98 5136 235 250 285 3634 2606 5982 120 21.6 2612 120 2136 2500 500 25 130 145 4230 3378 150 64 100 3119 Msunduzi Analytics is evaluating Naspers Inc using the FCFF valuation method. They have collected the following information: Naspers has an EBIT of 250 million, depreciation of 90 million, capital expenditures of 170 million and an increase in working capital of 40 milli on. Naspers has financed 40% of the capital expenditure and 40% of the increase in working capital with debt financing. Interest expenses are currently 150 million, whilst the current market value of Naspers's debt is 1 800million. The FCFF is expected to grow at a 10% rate for the next 3 years, thereafter, its growth should decline to a stable growth rate of 5%. The tax rate is 30%. The before-tax cost of debt is 9%, the cost of equity is 13%, and the WACC is 10%. Naspers has 10 million outstanding shares. Naspers current market value of debt is R3000 million. The current Free Cash Flow to the firm (FCFF) is equal to R 235 million. The increase in net debt is equal to R million. The current Free Cash Flow to Equity (FCFE) is equal to R million. The FCFF in year 3 is closest to R million. The terminal value at the end of year 3 is closest to R million. The current value of the firm (Naspers) is equal to R million, and the total value of equity is equal to R million. Chose an appropriate answer from the below table to fill in the blanks. 1 2 3 4 5 6 7 250 84 109 180 3047 208 130 210 214 173 2.86 3119.98 5136 235 250 285 3634 2606 5982 120 21.6 2612 120 2136 2500 500 25 130 145 4230 3378 150 64 100 3119

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts