Question: Muffin Corp. intends to acquire a new baking system. You have been asked to cecommend whether the system should be leased or purehased. The equipment

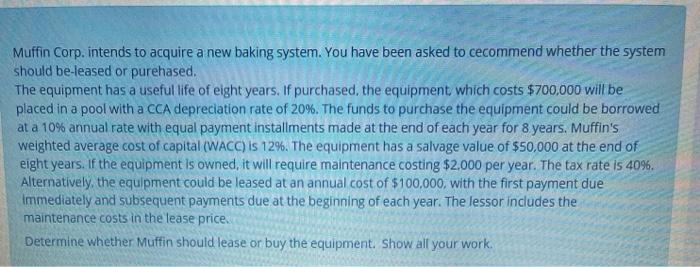

Muffin Corp. intends to acquire a new baking system. You have been asked to cecommend whether the system should be leased or purehased. The equipment has a useful life of eight years. If purchased the equipment which costs $700,000 will be placed in a pool with a CCA depreciation rate of 20%. The funds to purchase the equipment could be borrowed at a 10% annual rate with equal payment installments made at the end of each year for 8 years. Muffin's weighted average cost of capital (WACC) is 12%. The equipment has a salvage value of $50,000 at the end of eight years. If the equipment is owned, it will require maintenance costing $2.000 per year. The tax rate is 40%. Alternatively, the equipment could be leased at an annual cost of $100,000, with the first payment due immediately and subsequent payments due at the beginning of each year. The lessor includes the maintenance costs in the lease price Determine whether Muffin should lease or buy the equipment. Show all your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts