Question: Mullen Group is considering adding another division that requires a cash outlay of $30,000 and is expected to generate $7,760 in after-tax cash flows each

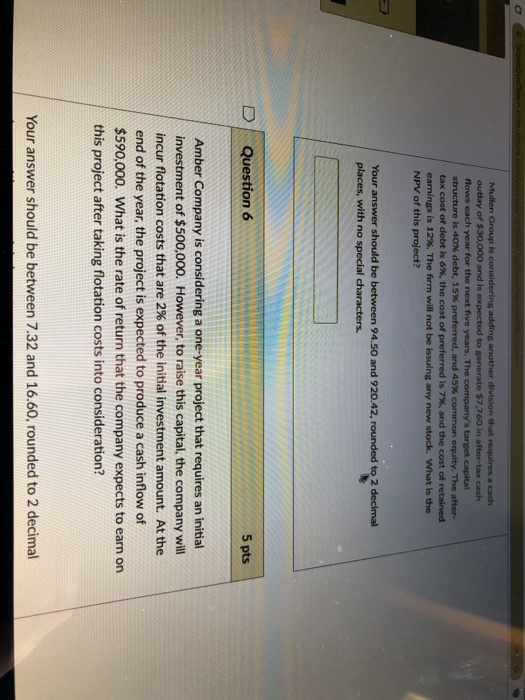

Mullen Group is considering adding another division that requires a cash outlay of $30,000 and is expected to generate $7,760 in after-tax cash flows each year for the next five years. The company's target capital structure is 40% debt, 15% tax cost of debt is 6%, the cost of preferred, and 45% common equity. The after- 157%, and the cost of retained earnings is 12%. The firm will not be issuing any new stock, what is the NPV of this project? Your answer should be between 94.50 and 920.42, rounded to 2 decimal places, with no special characters. DQuestion 6 5 pts Amber Company is considering a one-year project that requires an initial investment of $500,000. However, to raise this capital, the company will incur flotation costs that are 2% of the initial investment amount. At the end of the year, the project is expected to produce a cash inflow of $590,000. What is the rate of return that the company expects to earn on this project after taking flotation costs into consideration? Your answer should be between 7.32 and 16.60, rounded to 2 decimal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts