Question: Mullet Technologies is considering whether or not to refund a $250 million, 14% coupon, 30-year bond issue that was sold 5 years ago. It is

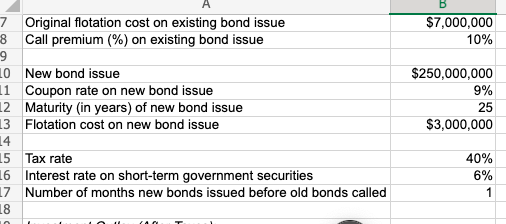

Mullet Technologies is considering whether or not to refund a $250 million, 14% coupon, 30-year bond issue that was sold 5 years ago. It is amortizing $7 million of flotation costs on the 14% bonds over the issue's 30-year life. Mullet's investment banks have indicated that the company could sell a new 25-year issue at an interest rate of 9% in today's market. Neither they nor Mullet's management anticipate that interest rates will fall below 9% any time soon, but there is a chance that rates will increase. A call premium of 10% would be required to retire the old bonds, and flotation costs on the new issue would amount to $3 million. Mullet's marginal federal- plus-state tax rate is 40%. The new bonds would be issued 1 month before the old bonds are called, with the proceeds being invested in short-term government securities returning 6% annually during the interim period. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet Conduct a complete bond refunding analysis. What is the bond refunding's NPV? Do not round intermediate calculations. Round your answer to the nearest dollar. 14.9 7 Original flotation cost on existing bond issue 8 Call premium (%) on existing bond issue 9 10 11 12 13 Flotation cost on new bond issue New bond issue Coupon rate on new bond issue Maturity (in years) of new bond issue 14 15 Tax rate 16 Interest rate on short-term government securities Number of months new bonds issued before old bonds called 17 18 $7,000,000 10% $250,000,000 9% 25 $3,000,000 40% 6% 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts