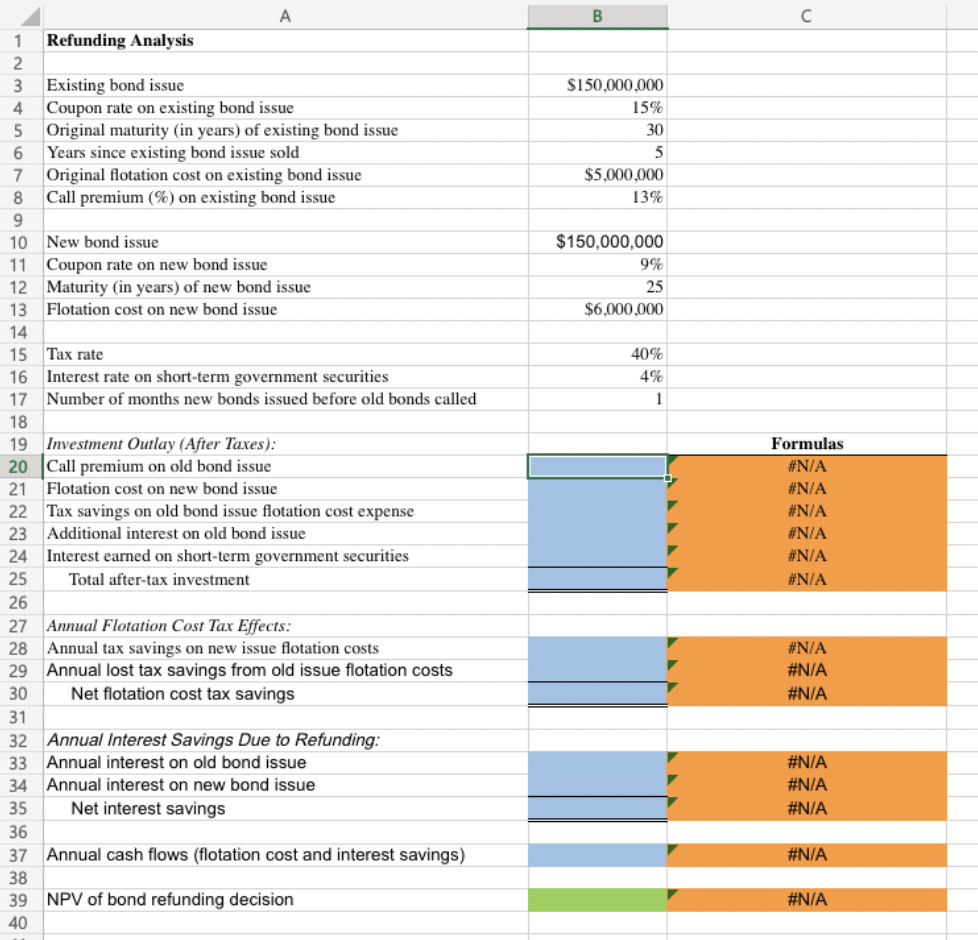

Question: Mullet Technologies is considering whether or not to refund a $150 million, 15% coupon, 30-year bond issue that was sold 5 years ago. it is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts