Question: Multinational Financial Management Please show work! Question 3. Options 2 ONLY!! 1. Futures and marking to market. a) Suppose that on Day 1 you buy

Multinational Financial Management

Please show work! Question 3. Options 2 ONLY!!

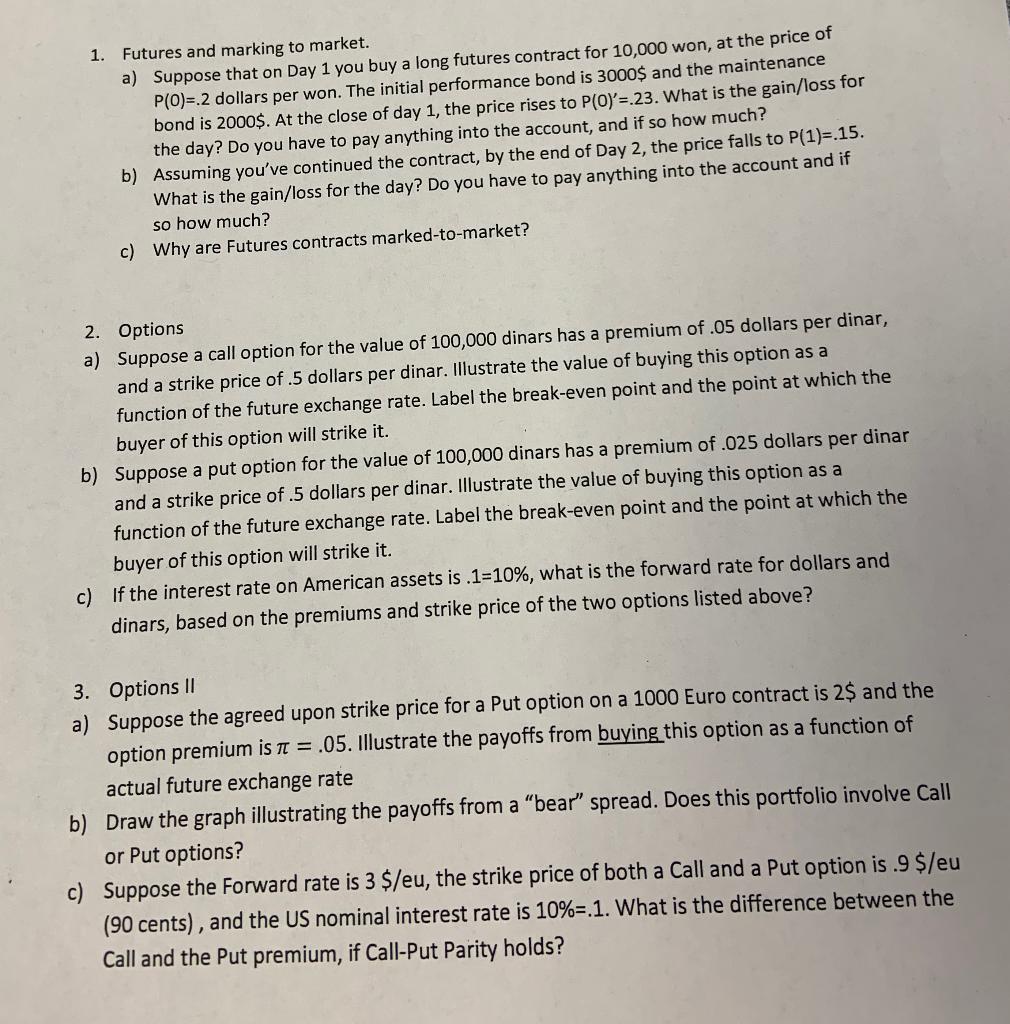

1. Futures and marking to market. a) Suppose that on Day 1 you buy a long futures contract for 10,000 won, at the price of P(0)=2 dollars per won. The initial performance bond is 3000$ and the maintenance bond is 2000$. At the close of day 1, the price rises to POY=.23. What is the gain/loss for the day? Do you have to pay anything into the account, and if so how much? b) Assuming you've continued the contract, by the end of Day 2, the price falls to P(1)=.15. What is the gain/loss for the day? Do you have to pay anything into the account and if so how much? c) Why are Futures contracts marked-to-market? 2. Options a) Suppose a call option for the value of 100,000 dinars has a premium of .05 dollars per dinar, and a strike price of .5 dollars per dinar. Illustrate the value of buying this option as a function of the future exchange rate. Label the break-even point and the point at which the buyer of this option will strike it. b) Suppose a put option for the value of 100,000 dinars has a premium of .025 dollars per dinar and a strike price of .5 dollars per dinar. Illustrate the value of buying this option as a function of the future exchange rate. Label the break-even point and the point at which the buyer of this option will strike it. c) If the interest rate on American assets is .1=10%, what is the forward rate for dollars and dinars, based on the premiums and strike price of the two options listed above? 3. Options 11 a) Suppose the agreed upon strike price for a Put option on a 1000 Euro contract is 2$ and the option premium is a = .05. Illustrate the payoffs from buying this option as a function of actual future exchange rate b) Draw the graph illustrating the payoffs from a "bear" spread. Does this portfolio involve Call or Put options? c) Suppose the Forward rate is 3 $/eu, the strike price of both a Call and a Put option is.9 $/eu (90 cents), and the US nominal interest rate is 10%=.1. What is the difference between the Call and the Put premium, if Call-Put Parity holds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts