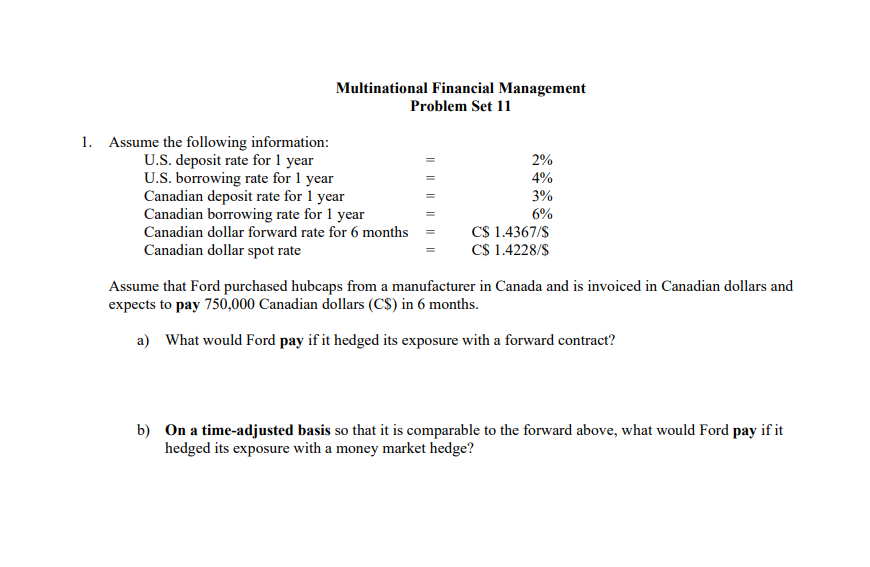

Question: Multinational Financial Management Problem Set 11 1. 2% 4% Assume the following information: U.S. deposit rate for 1 year U.S. borrowing rate for 1 year

Multinational Financial Management Problem Set 11 1. 2% 4% Assume the following information: U.S. deposit rate for 1 year U.S. borrowing rate for 1 year Canadian deposit rate for 1 year Canadian borrowing rate for 1 year Canadian dollar forward rate for 6 months = Canadian dollar spot rate 3% 6% C$ 1.4367/$ C$ 1.4228/$ Assume that Ford purchased hubcaps from a manufacturer in Canada and is invoiced in Canadian dollars and expects to pay 750,000 Canadian dollars (C$) in 6 months. a) What would Ford pay if it hedged its exposure with a forward contract? b) On a time-adjusted basis so that it is comparable to the forward above, what would Ford pay if it hedged its exposure with a money market hedge

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts