Question: Multiple Changes in Profit Plans In an attempt to improve profit performance, Anderson Companys management is considering a number of alternative actions. An October contribution

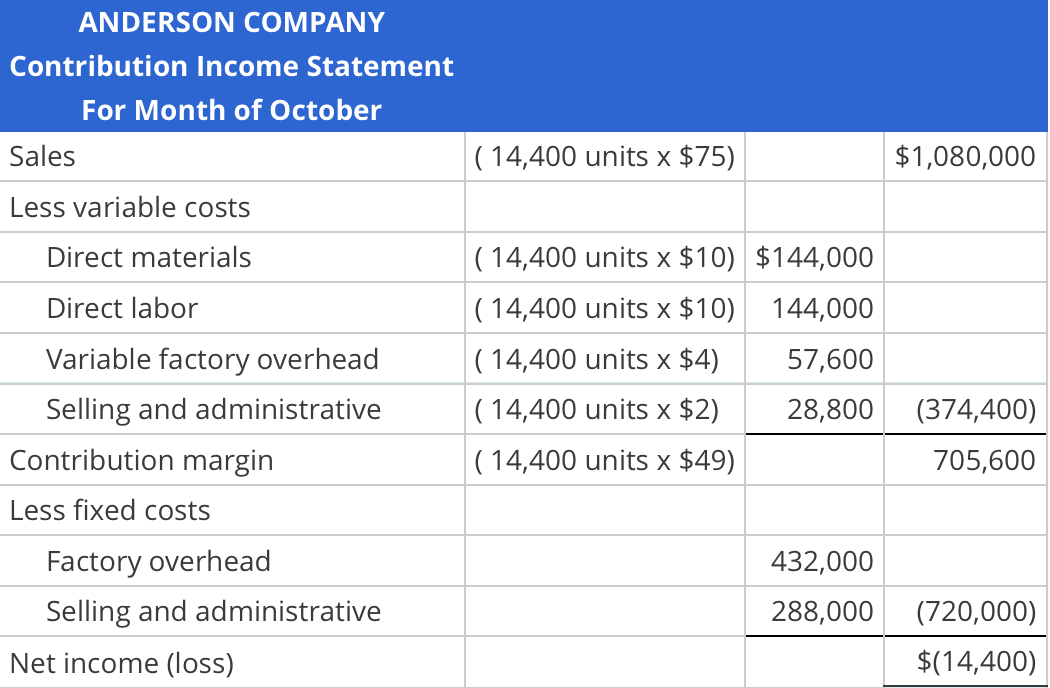

Multiple Changes in Profit Plans In an attempt to improve profit performance, Anderson Companys management is considering a number of alternative actions. An October contribution income statement for Anderson Company follows.

Required

Required

Determine the effect of each of the following independent situations on monthly profit.

Note: Do not use negative signs with your answers.

a. Purchasing automated assembly equipment, which should reduce direct labor costs by $4 per unit and increase variable overhead costs by $1 per unit and fixed factory overhead by $14,400 per month. Answer $Answer

b. Reducing the selling price by $5 per unit. This should increase the monthly sales by 3,600 units. At this higher volume, additional equipment and salaried personnel would be required. This will increase fixed factory overhead by $4,800 per month and fixed selling and administrative costs by $2,160 per month. Answer $Answer

c. Buying rather than manufacturing a component of Andersons final product. This will increase direct materials costs by $5 per unit. However, direct labor will decline $3 per unit, variable factory overhead will decline $1 per unit, and fixed factory overhead will decline $30,000 per month. Answer $Answer

d. Increasing the unit selling price by $5 per unit. This action should result in a 2,400 unit decrease in monthly sales. Answer $Answer

e. Combining alternatives (a) and (d). Answer $Answer

ANDERSON COMPANY Contribution Income Statement For Month of October \begin{tabular}{|l|l|r|r|} \hline Sales & (14,400 units x$75) & & $1,080,000 \\ \hline Less variable costs & & & \\ \hline Direct materials & (14,400 units x$10) & $144,000 & \\ \hline Direct labor & (14,400 units x$10) & 144,000 & \\ \hline Variable factory overhead & (14,400 units x$4) & 57,600 & \\ \hline Selling and administrative & (14,400 units x$2) & 28,800 & (374,400) \\ \hline Contribution margin & (14,400 units x$49) & & 705,600 \\ \hline Less fixed costs & & & \\ \hline Factory overhead & & 432,000 & \\ \hline Selling and administrative & & 288,000 & (720,000) \\ \hline Net income (loss) & & & $(14,400) \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts