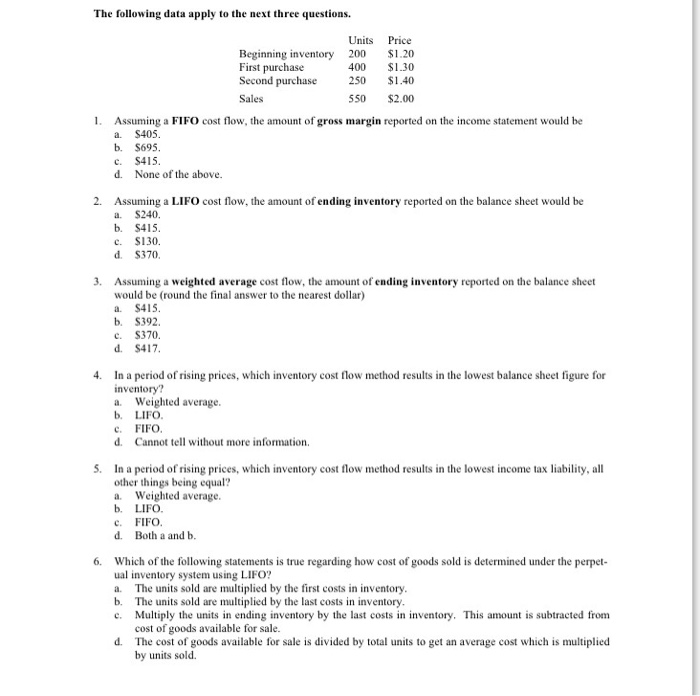

Question: Multiple choice 1 Assuming a FIFO cost flow, the amount of gross margin reported on the income statement would be a. $405 b. $695 C.

Assuming a FIFO cost flow, the amount of gross margin reported on the income statement would be a. $405 b. $695 C. $415 d. None of the above. Assuming a LIFO cost flow, the amount of ending inventory reported on the balance sheet would be a. $240. b. $415 c. $130. d. $370 Assuming a weighted average cost flow, the amount of ending inventory reported on the balance sheet would be (round the final answer to the nearest dollar) a. $415 b. $392. C. $370 d. $417 In a period of rising prices, which inventory cost flow method results in the lowest balance sheet figure for inventory? a. Weighted average b. LIFO c. FIFO. d. Cannot tell without more information. In a period of rising prices, which inventory cost flow method results in the lowest income tax liability, all other things being equal? a. Weighted average b. LIFO c. FIFCO d. Both a and b Which of the following statements is true regarding how cost of goods sold is determined under the perpetual inventory system using LIFO? a. The units sold are multiplied by the first costs in inventory. b The units sold are multiplied by the last costs in inventory c. Multiply the units in ending inventory by the last costs in inventory. d. This amount is subtracted from cost of goods available for sale. The cost of goods available for sale is divided by total units to get an average cost which is multiplied by units sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts