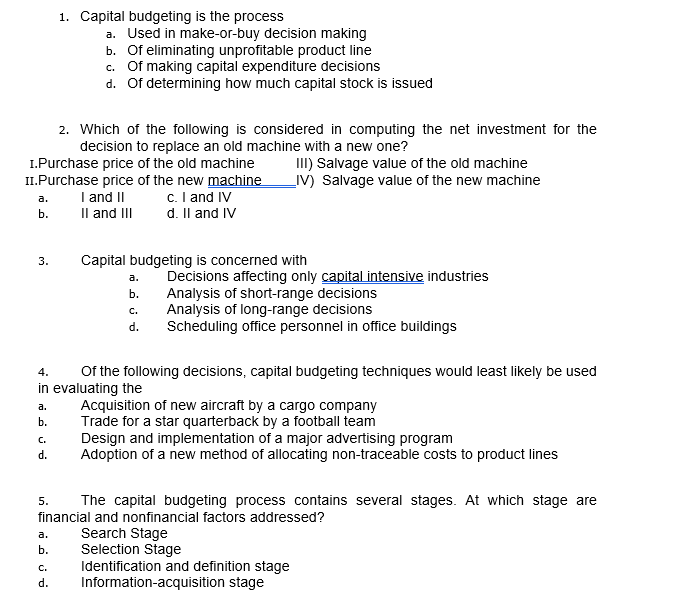

Question: Multiple Choice 1. Capital budgeting is the process a. Used in make-or-buy decision making b. Of eliminating unprofitable product line c. Of making capital expenditure

Multiple Choice

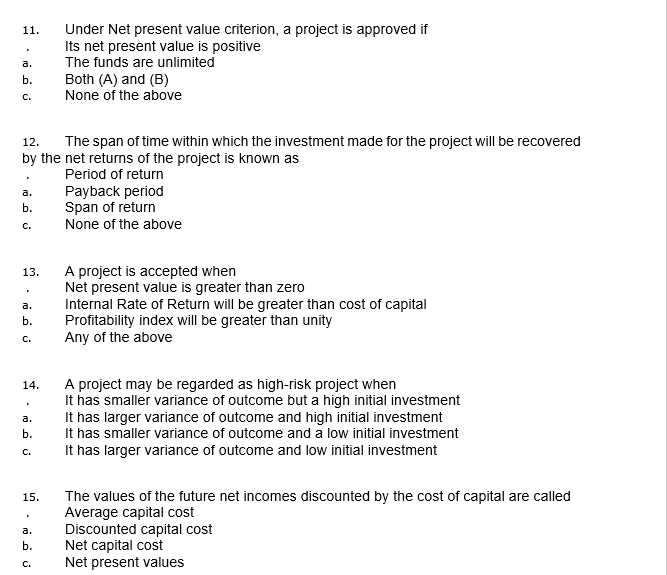

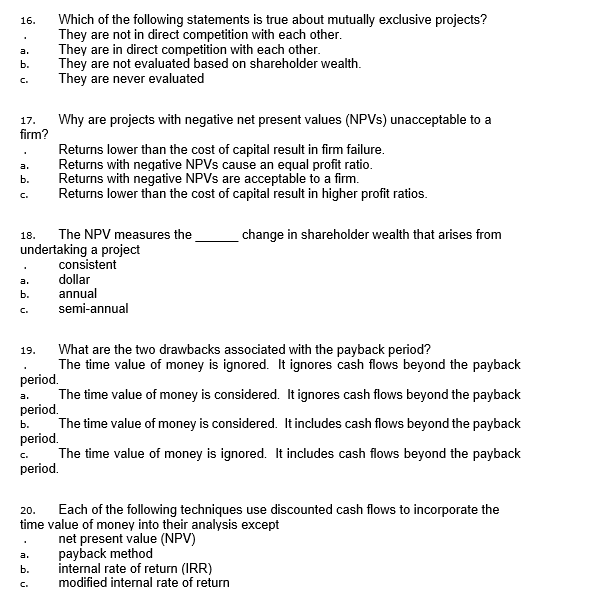

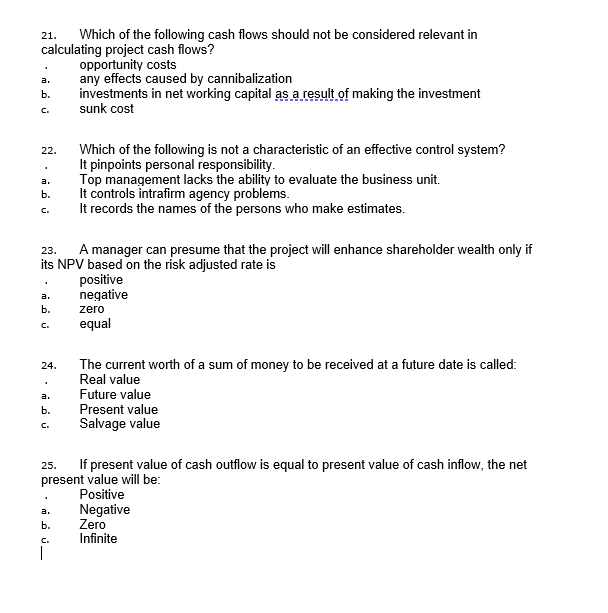

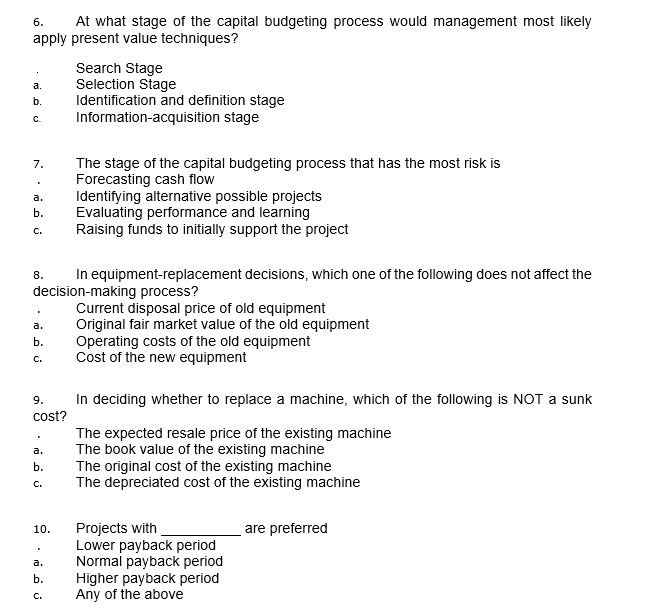

1. Capital budgeting is the process a. Used in make-or-buy decision making b. Of eliminating unprofitable product line c. Of making capital expenditure decisions d. Of determining how much capital stock is issued 2. Which of the following is considered in computing the net investment for the decision to replace an old machine with a new one? I.Purchase price of the old machine Ill) Salvage value of the old machine II.Purchase price of the new machine IV) Salvage value of the new machine I and II c. I and IV b. Il and Ill d. II and IV 3. Capital budgeting is concerned with a Decisions affecting only capital intensive industries b. Analysis of short-range decisions C. Analysis of long-range decisions d. Scheduling office personnel in office buildings 4. Of the following decisions, capital budgeting techniques would least likely be used n evaluating the a Acquisition of new aircraft by a cargo company b. Trade for a star quarterback by a football team C. Design and implementation of a major advertising program d. Adoption of a new method of allocating non-traceable costs to product lines 5. The capital budgeting process contains several stages. At which stage are financial and nonfinancial factors addressed? a. Search Stage b. Selection Stage C . Identification and definition stage d. Information-acquisition stage11 Under Net present value criterion, a project is approved if Its net present value is positive a. The funds are unlimited Both (A) and (B) C . None of the above 12. The span of time within which the investment made for the project will be recovered by the net returns of the project is known as Period of return a Payback period Span of return None of the above 13. A project is accepted when Net present value is greater than zero a Internal Rate of Return will be greater than cost of capital Profitability index will be greater than unity C. Any of the above 14 A project may be regarded as high-risk project when It has smaller variance of outcome but a high initial investment It has larger variance of outcome and high initial investment It has smaller variance of outcome and a low initial investment C. It has larger variance of outcome and low initial investment 15. The values of the future net incomes discounted by the cost of capital are called Average capital cost a. Discounted capital cost Net capital cost Net present values16. Which of the following statements is true about mutually exclusive projects? They are not in direct competition with each other. They are in direct competition with each other. They are not evaluated based on shareholder wealth. n They are never evaluated 17. Why are projects with negative net present values (NPVs) unacceptable to a firm? Returns lower than the cost of capital result in firm failure. Returns with negative NPVs cause an equal profit ratio. Returns with negative NPVs are acceptable to a firm. C. Returns lower than the cost of capital result in higher profit ratios. 18. The NPV measures the change in shareholder wealth that arises from undertaking a project consistent dollar b. annual semi-annual 19. What are the two drawbacks associated with the payback period? The time value of money is ignored. It ignores cash flows beyond the payback period. The time value of money is considered. It ignores cash flows beyond the payback period. b. The time value of money is considered. It includes cash flows beyond the payback period The time value of money is ignored. It includes cash flows beyond the payback period. 20. Each of the following techniques use discounted cash flows to incorporate the time value of money into their analysis except net present value (NPV) payback method internal rate of retum (IRR) modified internal rate of return21. Which of the following cash flows should not be considered relevant in calculating project cash flows? opportunity costs a. any effects caused by cannibalization b. investments in net working capital as a result of making the investment sunk cost 22. Which of the following is not a characteristic of an effective control system? It pinpoints personal responsibility. 3. Top management lacks the ability to evaluate the business unit. It controls intrafirm agency problems. It records the names of the persons who make estimates. 23. A manager can presume that the project will enhance shareholder wealth only if its NPV based on the risk adjusted rate is positive 3. negative zero equal 24. The current worth of a sum of money to be received at a future date is called: Real value Future value b . Present value Salvage value 25. If present value of cash outflow is equal to present value of cash inflow, the net present value will be: Positive 3. Negative Zero Infinite5. At what stage of the capital budgeting process would management most likely apply present value techniques? Search Stage Selection Stage Identification and definition stage Information-acquisition stage 7. The stage of the capital budgeting process that has the most risk is Forecasting cash flow a. Identifying alternative possible projects b. Evaluating performance and learning C. Raising funds to initially support the project B. In equipment-replacement decisions, which one of the following does not affect the decision-making process? Current disposal price of old equipment a Original fair market value of the old equipment b. Operating costs of the old equipment C. Cost of the new equipment 9. In deciding whether to replace a machine, which of the following is NOT a sunk cost? The expected resale price of the existing machine The book value of the existing machine The original cost of the existing machine C. The depreciated cost of the existing machine 10. Projects with are preferred Lower payback period a. Normal payback period b. Higher payback period Any of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts