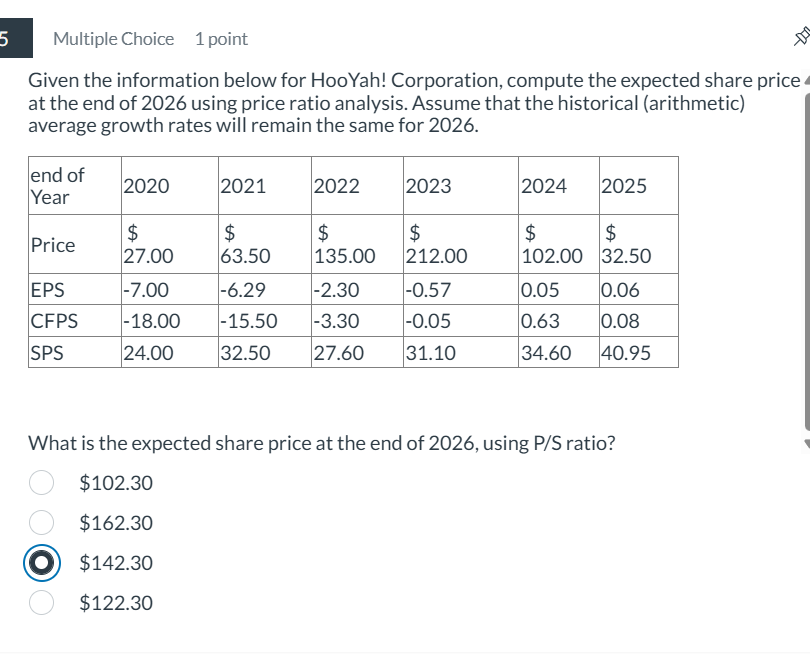

Question: Multiple Choice 1 point Given the information below for HooYah! Corporation, compute the expected share price at the end of 2 0 2 6 using

Multiple Choice point Given the information below for HooYah! Corporation, compute the expected share price at the end of using price ratio analysis. Assume that the historical arithmetic average growth rates will remain the same for begintabularlllllllhline end of Year & & & & & & hline Price & $ & $ & $ & $ & $ & $ hline EPS & & & & & & hline CFPS & & & & & & hline SPS & & & & & & hline endtabular What is the expected share price at the end of using PS ratio? beginarrayl$ $ $ $ endarray

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock