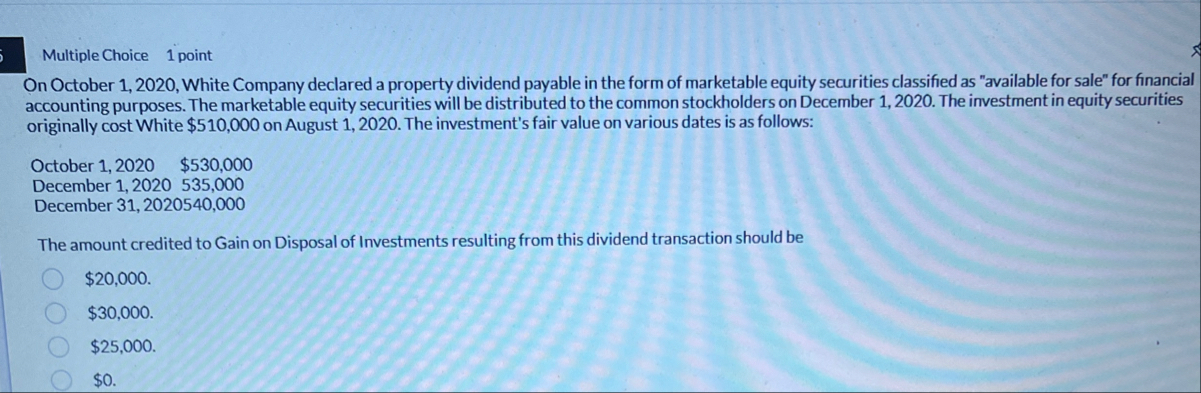

Question: Multiple Choice 1 point On October 1 , 2 0 2 0 , White Company declared a property dividend payable in the form of marketable

Multiple Choice

point

On October White Company declared a property dividend payable in the form of marketable equity securities classified as "available for sale" for financial accounting purposes. The marketable equity securities will be distributed to the common stockholders on December The investment in equity securities originally cost White $ on August The investment's fair value on various dates is as follows:

October $

December

December

The amount credited to Gain on Disposal of Investments resulting from this dividend transaction should be

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock