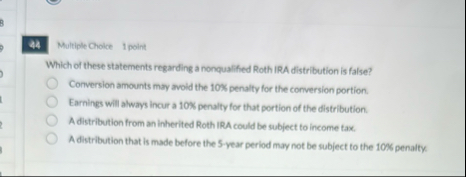

Question: Multiple Choice 1 point Which ed there statements Tegarding a nonqualified Roth IRA distribution is false? Conversion amounts may avold the 1 0 % penalty

Multiple Choice point

Which ed there statements Tegarding a nonqualified Roth IRA distribution is false?

Conversion amounts may avold the penalty for the conversion portion.

Earnings will always incur a penalty for that portion of the distribution.

A distribution from an inherited Roth IRA could be subject to income tax.

A distribution that is made before the year period may not be subject to the penalty.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock