Question: Multiple Choice: 1. Under a defined contribution pension plan, a. the pension expense account must be determined by actuarial calculations. the employer guarantees the emplovee

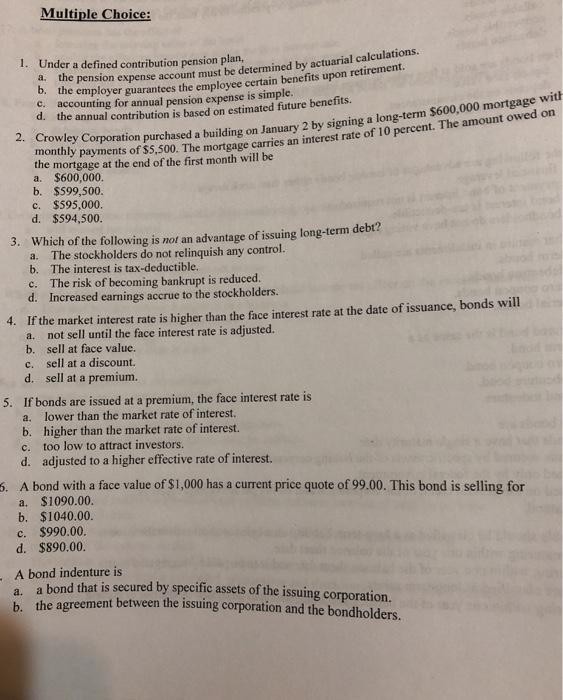

Multiple Choice: 1. Under a defined contribution pension plan, a. the pension expense account must be determined by actuarial calculations. the employer guarantees the emplovee certain benefits upon retirement. simple c. d. 2. Crowle accounting for annual pension expense is the annual contribution is based on estimated future benefits. y Corporation purchased a building on January 2 by signing a long-term $600,000 mortgage with f 10 percent. The amount owed on monthly payments of $5,500. The mortgage carries an interest rate o the mortgage at the end of the first month will be a. $600,000. b. $599,500 c. $595,000. d. $594,500. 3. Which of the following is not an advantage of issuing long-term debt? The stockholders do not relinquish any control. a. b. The interest is tax-deductible. c. The risk of becoming bankrupt is reduced. d. Increased earnings accrue to the stockholders. 4. If the market interest rate is higher than the face interest rate at the date of issuance, bonds will a. not sell until the face interest rate is adjusted. b. sell at face value. c. sell at a discount. d. sell at a premium. 5. If bonds are issued at a premium, the face interest rate is a. lower than the market rate of interest. b. higher than the market rate of interest. too low to attract investors. adjusted to a higher effective rate of interest. c. d. 6. A bond with a face value of $1,000 has a current price quote of 99.00. This bond is selling for a. $1090.00. b. $1040.00 c. $990.00. d. $890.00. A bond indenture is a. a b. the agree bond that is secured by specific assets of the issuing corporation. ment between the issuing corporation and the bondholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts