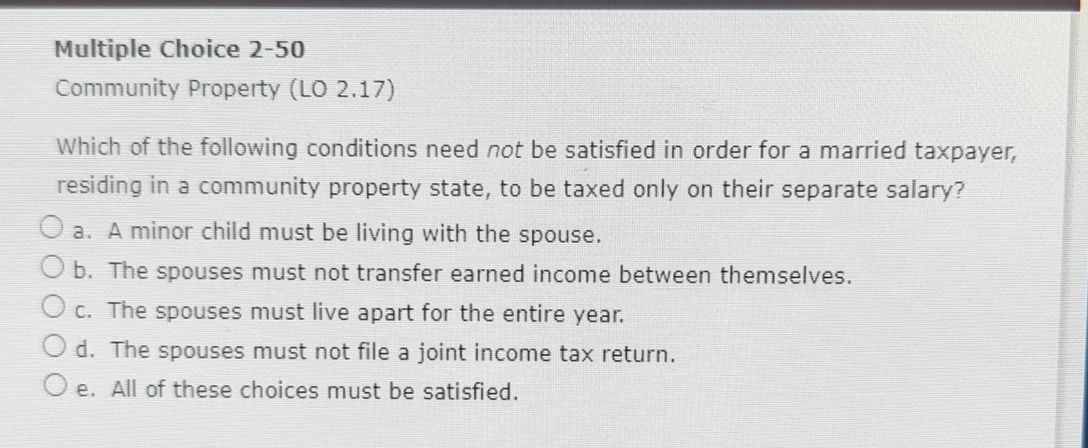

Question: Multiple Choice 2 - 5 0 Community Property ( LO 2 . 1 7 ) Which of the following conditions need not be satisfied in

Multiple Choice

Community Property LO

Which of the following conditions need not be satisfied in order for a married taxpayer,

residing in a community property state, to be taxed only on their separate salary?

a A minor child must be living with the spouse.

b The spouses must not transfer earned income between themselves.

c The spouses must live apart for the entire year.

d The spouses must not file a joint income tax return.

e All of these choices must be satisfied.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock