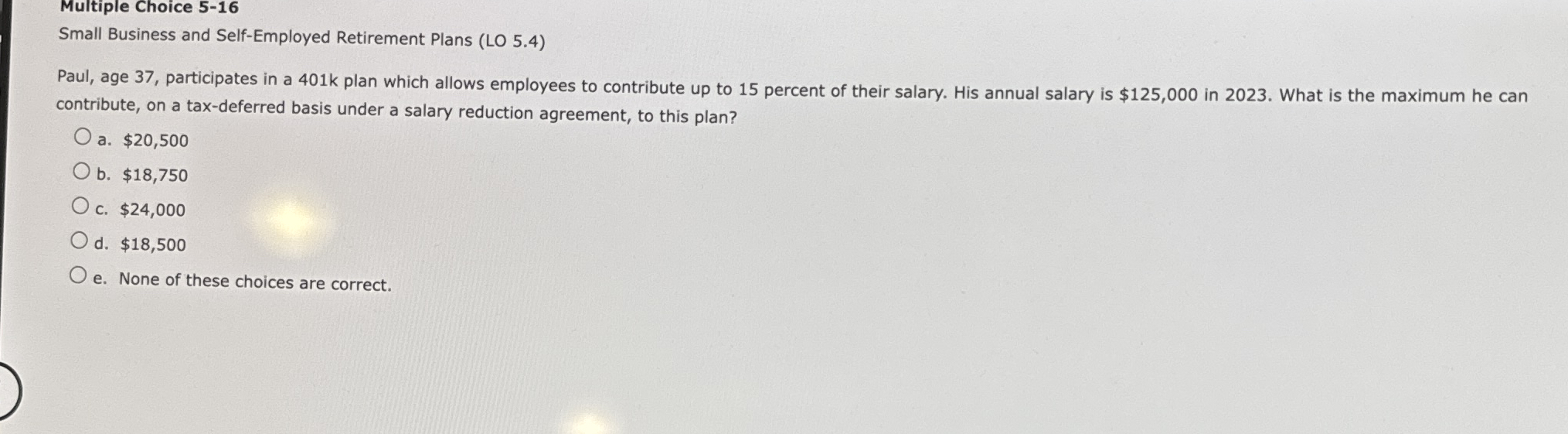

Question: Multiple Choice 5 - 1 6 Small Business and Self - Employed Retirement Plans ( LO 5 . 4 ) Paul, age 3 7 ,

Multiple Choice

Small Business and SelfEmployed Retirement Plans LO

Paul, age participates in a k plan which allows employees to contribute up to percent of their salary. His annual salary is $ in What is the maximum he can

contribute, on a taxdeferred basis under a salary reduction agreement, to this plan?

a $

b $

c $

d $

e None of these choices are correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock