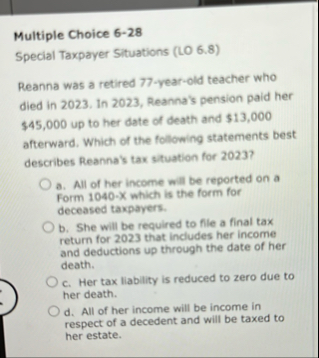

Question: Multiple Choice 6 - 2 8 Special Taxpayer Situations ( LO 6 . 8 ) Reanna was a retired 7 7 - year - old

Multiple Choice

Special Taxpayer Situations LO

Reanna was a retired yearold teacher who died in In Reanna's pension paid her $ up to her date of death and $ afterward. Which of the following statements best describes Reanna's tax situation for

a All of her income will be reported on a Form X which is the form for deceased taxpayers.

b She will be required to file a final tax return for that includes her income and deductions up through the date of her death.

c Her tax liability is reduced to zero due to her death.

d All of her income will be income in respect of a decedent and will be taxed to her estate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock