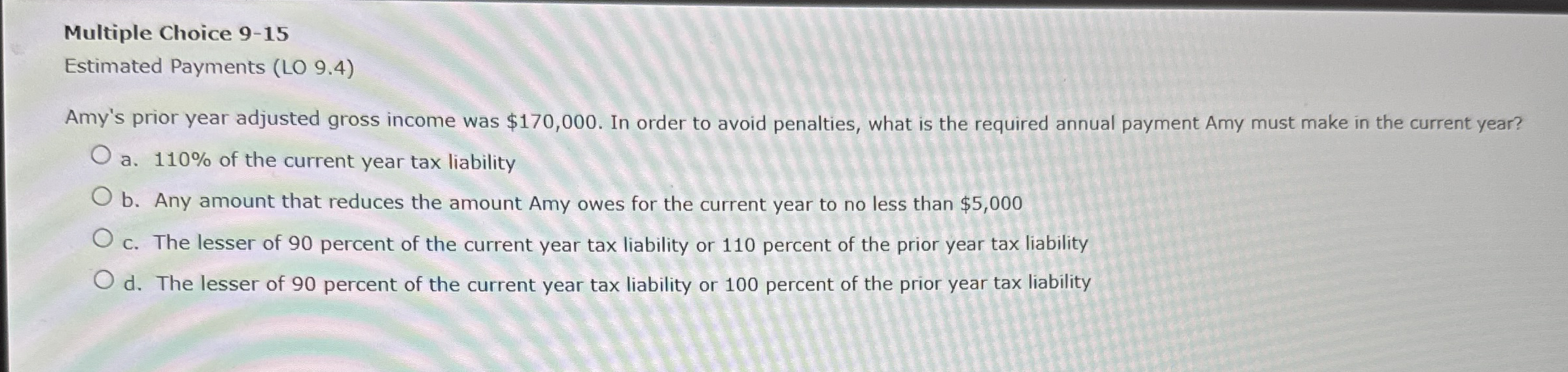

Question: Multiple Choice 9 - 1 5 Estimated Payments ( LO 9 . 4 ) Amy's prior year adjusted gross income was $ 1 7 0

Multiple Choice

Estimated Payments LO

Amy's prior year adjusted gross income was $ In order to avoid penalties, what is the required annual payment Amy must make in the current year?

a of the current year tax liability

b Any amount that reduces the amount Amy owes for the current year to no less than $

c The lesser of percent of the current year tax liability or percent of the prior year tax liability

d The lesser of percent of the current year tax liability or percent of the prior year tax liability

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock