Question: Multiple choice 9- 13. 9. In determining the allowable annual addition to a 45-year old participant to a defined-contribution pension plan account for 2018, the

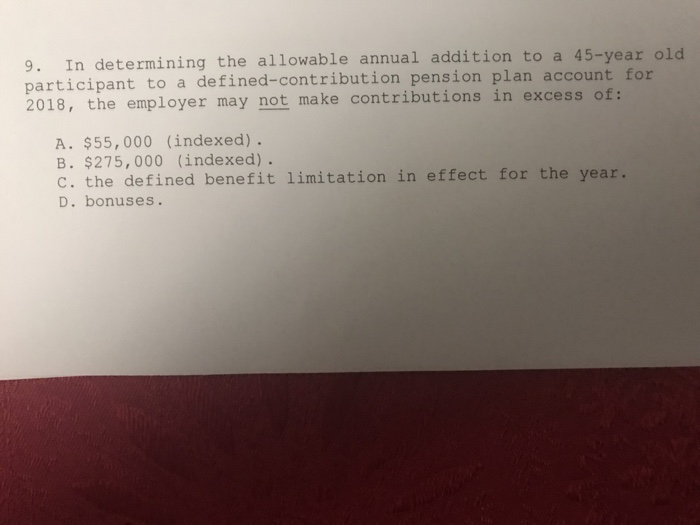

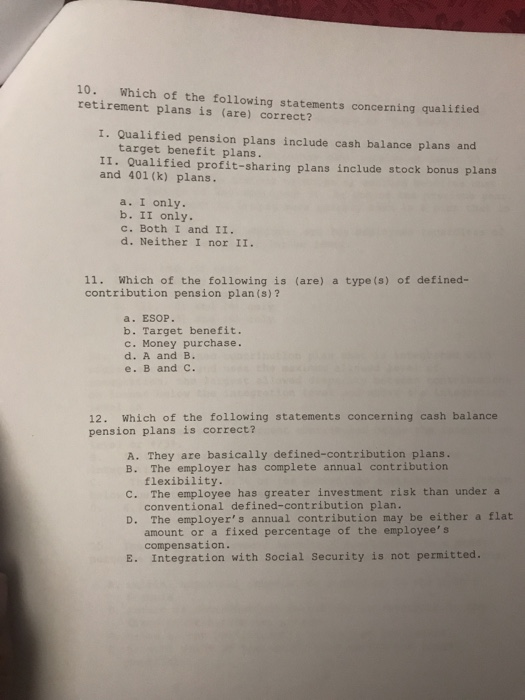

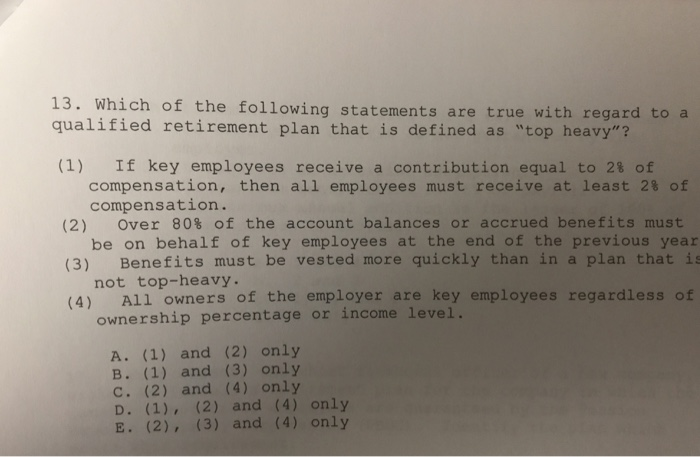

9. In determining the allowable annual addition to a 45-year old participant to a defined-contribution pension plan account for 2018, the em ployer may not make contributions in excess of: A. $55,000 (indexed). B. $275,000 (indexed) . c. the defined benefit limitation in effect for the year. D. bonuses. 10. Which of the following statements concerning qualified retirement plans is (are) correct? I. Qualified pension plans include cash balance plans and target benefit plans. II. Qualified profit-sharing plans include stock bonus plans and 401 (k) plans. a. I only. b. II only c. Both I and II. d. Neither I nor II. 11. Which of the following is (are) a type(s) of defined- contribution pension plan (s)2 a. ESOP. b. Target benefit. c. Money purchase. d. A and B. e" B and C. 12. Which of the following statements concerning cash balance pension plans is correct? A. They are basically defined-contribution plans. B. The employer has complete annual contribution flexibility. conventional defined-contribution plan. amount or a fixed percentage of the employee' s C. The employee has greater investment risk than under a D. The employer' s annual contribution may be either a flat compensation. E. Integration with Social Security is not permitted. 13. Whi qualified retirement plan that is defined as "top heavy"? ch of the following statements are true with regard to a (1) If key employees receive a contribution equal to 2% of compensation, then all employees must receive at least 2% of compensation. (2) Over 80% of the account balances or accrued benefits must (3) Benefits must be vested more quickly than in a plan that is (4) All owners of the employer are key employees regardless of be on behalf of key employees at the end of the previous year not top-heavy. ownership percentage or income level. A. (1) and (2) only B. (1) and (3) only C. (2) and (4) only D. (1), (2) and (4) only E. (2), (3) and (4) only

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts