Question: multiple choice accounting PAS12 216 PAS 12 . d. Deferred tax assets and deferred tax liabilities are off- balance sheet items, meaning they are not

multiple choice accounting PAS12

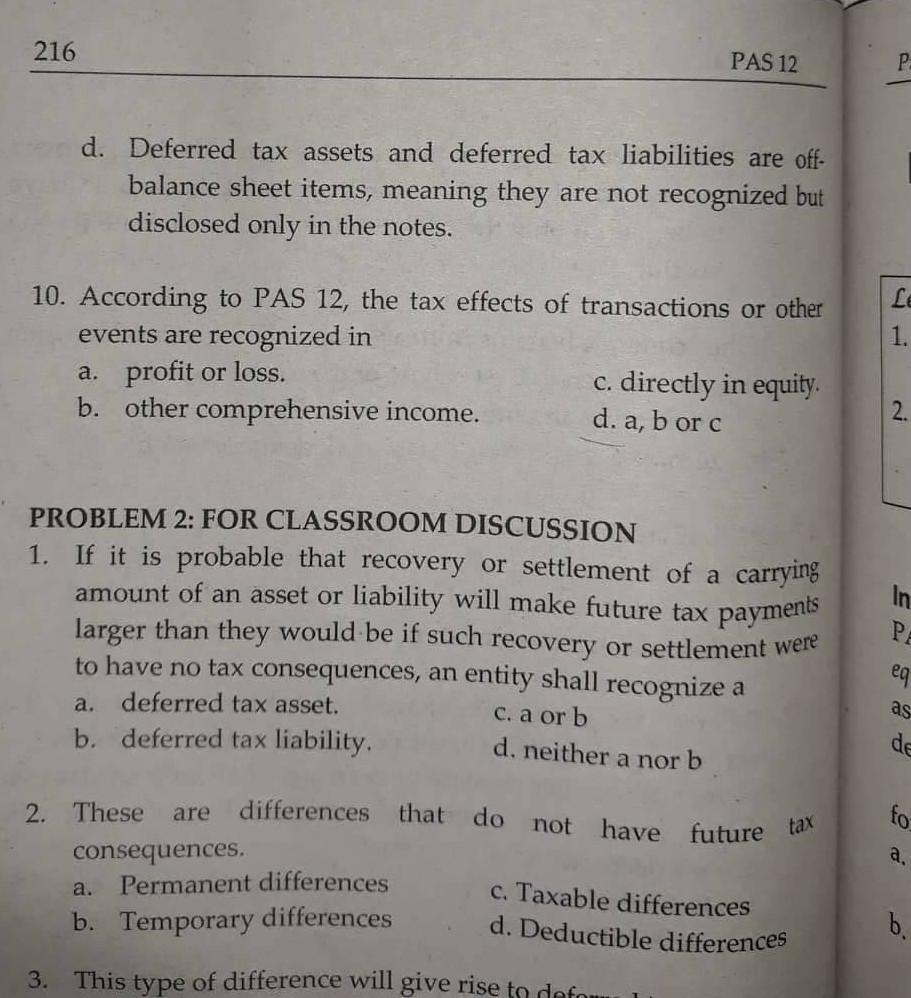

216 PAS 12 . d. Deferred tax assets and deferred tax liabilities are off- balance sheet items, meaning they are not recognized but disclosed only in the notes. LE 1. 10. According to PAS 12, the tax effects of transactions or other events are recognized in a. profit or loss. c. directly in equity b. other comprehensive income. d. a, b or c 2. PROBLEM 2: FOR CLASSROOM DISCUSSION 1. If it is probable that recovery or settlement of a carrying amount of an asset or liability will make future tax payments larger than they would be if such recovery or settlement were to have no tax consequences, an entity shall recognize a a. deferred tax asset. c. a orb b. deferred tax liability. d. neither a nor b In PE eg as differences that do not have future tax fo a. 2. These are consequences. a. Permanent differences b. Temporary differences c. Taxable differences d. Deductible differences b 3. This type of difference will give rise to defo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts