Question: Multiple Choice and True False questions pointeach) The basic factors to the evaluated in the creditevation process, the five Cs of creditare condities, control catal-

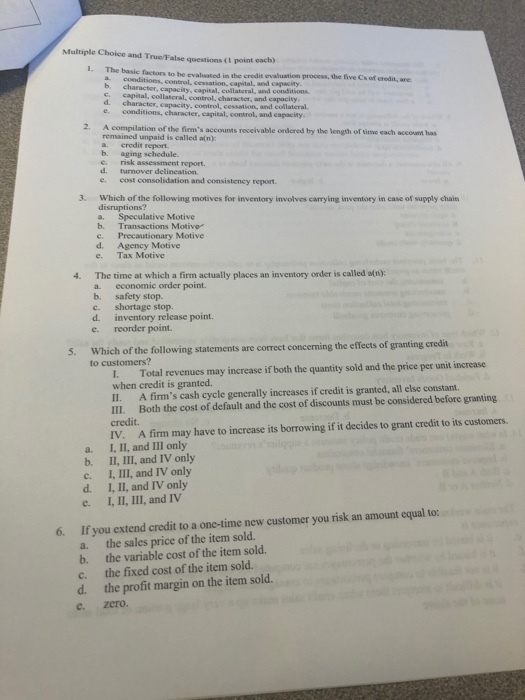

Multiple Choice and True False questions pointeach) The basic factors to the evaluated in the creditevation process, the five Cs of creditare condities, control catal- b character city lolalal, and c ons c. capital, collateral control, character, and capacity d. character, capacity, control cessation, and collateral e conditions, character, capital control, and capacity. 2. A compilation of the firm's accounts receivable ordered by the length of time each c remained unpaid is called an): credit report b. aging schedule. c risk assessment report. d. turnover delineation e cost consolidation and consistency report h as Which of the following motives for inventory involves carrying inventory in case of supply chain disruptions? a. Speculative Motive b. Transactions Motive c. Precautionary Motive d. Agency Motive e. Tax Motive 4. The time at which a firm actually places an inventory order is called an): a. economic order point. b. safety stop. c. shortage stop. d. inventory release point. e. reorder point. 5. Which of the following statements are correct concerning the effects of granting credit to customers? I. Total revenues may increase if both the quantity sold and the price per unit increase when credit is granted. II. A firm's cash cycle generally increases if credit is granted, all else constant III. Both the cost of default and the cost of discounts must be considered before granting credit. IV. A firm may have to increase its borrowing if it decides to grant credit to its customers. I, II, and Ill only b. II, III and IV only c. I, III, and IV only d. I. II, and IV only e. I, II, III, and IV 6. If you extend credit to a one-time new customer you risk an amount equal to: a. the sales price of the item sold. b. the variable cost of the item sold. c. the fixed cost of the item sold. d. the profit margin on the item sold. e zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts