Question: Multiple choice answers are for question C Not raise dividends because companies should always reinvest as much as possible. Not raise dividends because projects have

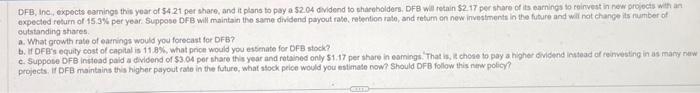

Not raise dividends because companies should always reinvest as much as possible. Not raise dividends because projects have positive NPV when the return on new investments is higher than the firm's cost of capital. Raise dividends because, according to the dividend-discount model, doing so will always improtie the share price. Raise dividends because the return on new investments is lower than the cost of capital. DFB, inc, expocts earnings this yoar of 54.21 per share, and it plans to pay a 52.04 dvidend to ohacobolders, DFB wil retain $2.17 per share of its earnings to roirvest in new grojocis with an oxpected resurn of 15.3% per year. Suppose DFB will maintain the same dividend payout rato, retention rato, and retum on new investments in the future and wall not change its number of outstanding shares. a. What growth rate of earnings would you forecast for DFB? b. If OFB's equily cost of capital is 11.8%, what pron would you estenate for OFB stock? c. Suppote DFB instoad paid a dividend of $3.04 por share this year and rotained only 51.17 per thare in esmings. That in, it chese to pay a higher dividend initead of remvesting in as many new projects. If DFB maintains this higher payout rale in the future, what stock perice would you estinate now? Should DFB follow this nerw pobic?? Not raise dividends because companies should always reinvest as much as possible. Not raise dividends because projects have positive NPV when the return on new investments is higher than the firm's cost of capital. Raise dividends because, according to the dividend-discount model, doing so will always improtie the share price. Raise dividends because the return on new investments is lower than the cost of capital. DFB, inc, expocts earnings this yoar of 54.21 per share, and it plans to pay a 52.04 dvidend to ohacobolders, DFB wil retain $2.17 per share of its earnings to roirvest in new grojocis with an oxpected resurn of 15.3% per year. Suppose DFB will maintain the same dividend payout rato, retention rato, and retum on new investments in the future and wall not change its number of outstanding shares. a. What growth rate of earnings would you forecast for DFB? b. If OFB's equily cost of capital is 11.8%, what pron would you estenate for OFB stock? c. Suppote DFB instoad paid a dividend of $3.04 por share this year and rotained only 51.17 per thare in esmings. That in, it chese to pay a higher dividend initead of remvesting in as many new projects. If DFB maintains this higher payout rale in the future, what stock perice would you estinate now? Should DFB follow this nerw pobic

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts