Question: Multiple Choice. Check the correct answer 1. Job order costing would be most appropriate for which of the following products, and why? O Cookies, since

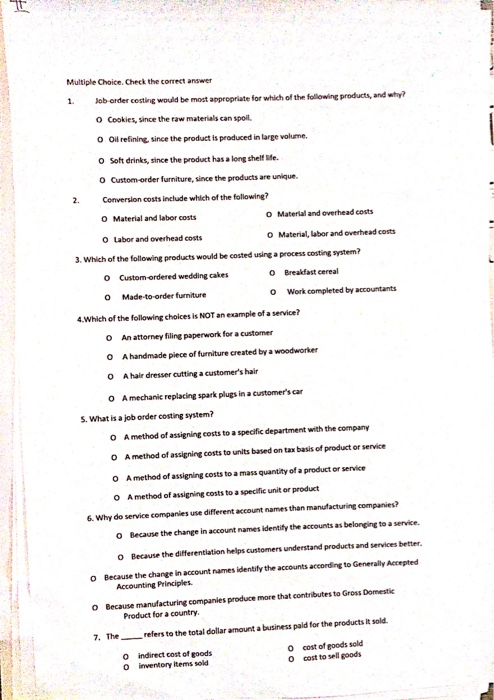

Multiple Choice. Check the correct answer 1. Job order costing would be most appropriate for which of the following products, and why? O Cookies, since the raw materials can spoil o Oil refining since the product is produced in large volume. osoft drinks, since the product has a long shelf life. o Custom order furniture, since the products are unique 2. Conversion costs include which of the following? O Material and labor costs o Material and overhead costs o Labor and overhead costs Material, labor and overhead costs 3. Which of the following products would be costed using a process costing system? o Custom ordered wedding cakes O Breakfast cereal o Made-to-order furniture o Work completed by accountants 4. Which of the following choices is NOT an example of a service? An attorney filing paperwork for a customer A handmade piece of furniture created by a woodworker O A hairdresser cutting a customer's hair O A mechanic replacing spark plugs in a customer's car 5. What is a job order costing system? A method of assigning costs to a specific department with the company A method of assigning costs to units based on tax basis of product or service A method of assigning costs to a mass quantity of a product or service A method of assigning costs to a specific unit or product 6. Why do service companies use different account names than manufacturing companies? Because the change in account names identify the accounts as belonging to a service. o Because the differentilation helps customers understand products and services better Because the change in account names identify the accounts according to Generally Accepted Accounting Principles O Because manufacturing companies produce more that contributes to Gross Domestic Product for a country 7. Therefers to the total dollar amount a business paid for the products it sold. o indirect cost of goods O inventory Items sold O cost of goods sold O cost to sell goods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts