Question: MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the que 40) Which of the following is TRUE of the balance

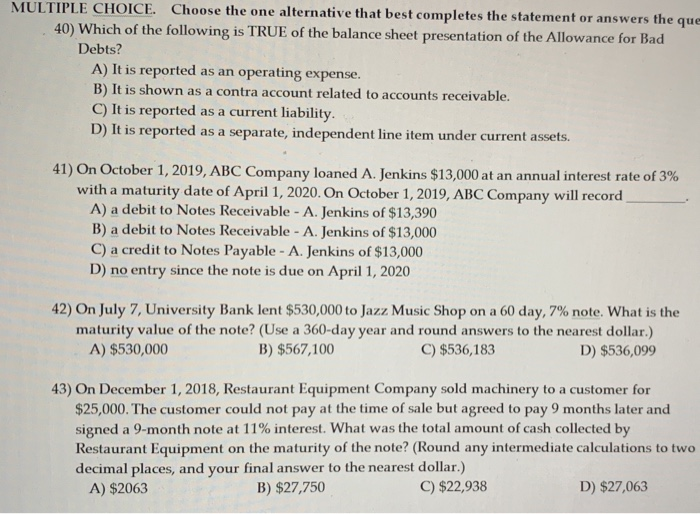

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the que 40) Which of the following is TRUE of the balance sheet presentation of the Allowance for Bad Debts? A) It is reported as an operating expense. B) It is shown as a contra account related to accounts receivable. C) It is reported as a current liability. D) It is reported as a separate, independent line item under current assets. 41) On October 1, 2019, ABC Company loaned A. Jenkins $13,000 at an annual interest rate of 3% with a maturity date of April 1, 2020. On October 1, 2019, ABC Company will record A) a debit to Notes Receivable - A. Jenkins of $13,390 B) a debit to Notes Receivable - A. Jenkins of $13,000 C) a credit to Notes Payable - A. Jenkins of $13,000 D) no entry since the note is due on April 1, 2020 42) On July 7, University Bank lent $530,000 to Jazz Music Shop on a 60 day, 7% note. What is the maturity value of the note? (Use a 360-day year and round answers to the nearest dollar.) A) $530,000 B) $567,100 C) $536,183 D) $536,099 43) On December 1, 2018, Restaurant Equipment Company sold machinery to a customer for $25,000. The customer could not pay at the time of sale but agreed to pay 9 months later and signed a 9-month note at 11% interest. What was the total amount of cash collected by Restaurant Equipment on the maturity of the note? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.) A) $2063 B) $27,750 C) $22,938 D) $27,063

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts