Question: MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) The expected return on a portfolio: 3579 Om o

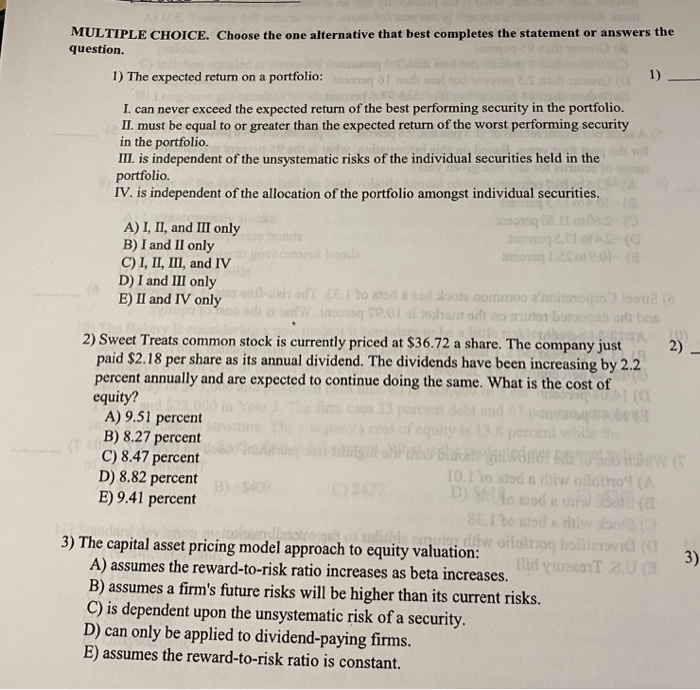

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) The expected return on a portfolio: 3579 Om o I can never exceed the expected return of the best performing security in the portfolio. II. must be equal to or greater than the expected return of the worst performing security in the portfolio. III. is independent of the unsystematic risks of the individual securities held in the portfolio. IV. is independent of the allocation of the portfolio amongst individual securities. A) I, II, and III only B) I and II only C) I, II, III, and IV D) I and III only E) II and IV only oraz odtod on nomuros a groale o W rola dosad no morbotol bois 2) Sweet Treats common stock is currently priced at $36.72 a share. The company just 2) paid $2.18 per share as its annual dividend. The dividends have been increasing by 2.2 percent annually and are expected to continue doing the same. What is the cost of equity? A) 9.51 percent B) 8.27 percent ostales como C) 8.47 percent D) 8.82 percent E) 9.41 percent Bosidades 3) The capital asset pricing model approach to equity valuation: iw olotitog boravi 3) A) assumes the reward-to-risk ratio increases as beta increases. Ilid oT 2.0 B) assumes a firm's future risks will be higher than its current risks. C) is dependent upon the unsystematic risk of a security. D) can only be applied to dividend-paying firms. E) assumes the reward-to-risk ratio is constant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts