Question: MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) What is a firm's gross profit? A) the difference

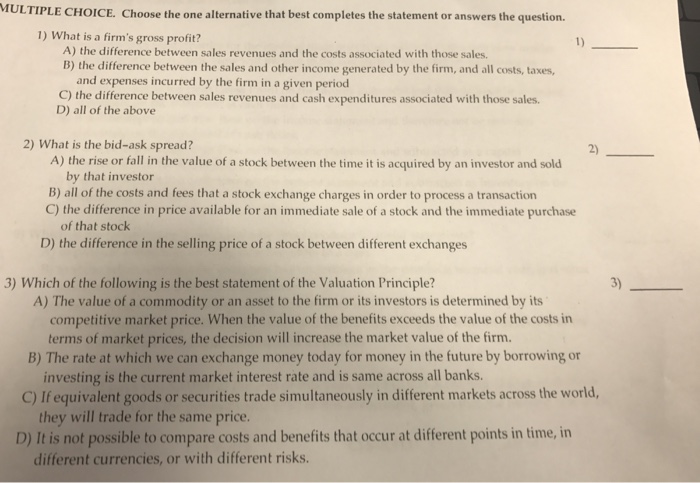

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) What is a firm's gross profit? A) the difference between sales revenues and the costs associated with those sales. B) the difference between the sales and other income generated by the firm, and all costs, taxes, and expenses incurred by the firm in a given period C) the difference between sales revenues and cash expenditures associated with those sales. D) all of the above 2) What is the bid-ask spread? 2) A) the rise or fall in the value of a stock between the time it is acquired by an investor and sold by that investor B) all of the costs and fees that a stock exchange charges in order to process a transaction C) the difference in price available for an immediate sale of a stock and the immediate purchase of that stock D) the difference in the selling price of a stock between different exchanges 3) Which of the following is the best statement of the Valuation Principle? 3) A) The value of a commodity or an asset to the firm or its investors is determined by its competitive market price. When the value of the benefits exceeds the value of the costs in terms of market prices, the decision will increase the market value of the firm. B) The rate at which we can exchange money today for money in the future by borrowing or investing is the current market interest rate and is same across all banks. they will trade for the same price. different currencies, or with different risks. C) If equivalent goods or securities trade simultaneously in different markets across the world, D) It is not possible to compare costs and benefits that occur at different points in time, in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts