Question: MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) Jessica owned 200 shares of OK Corporation with a

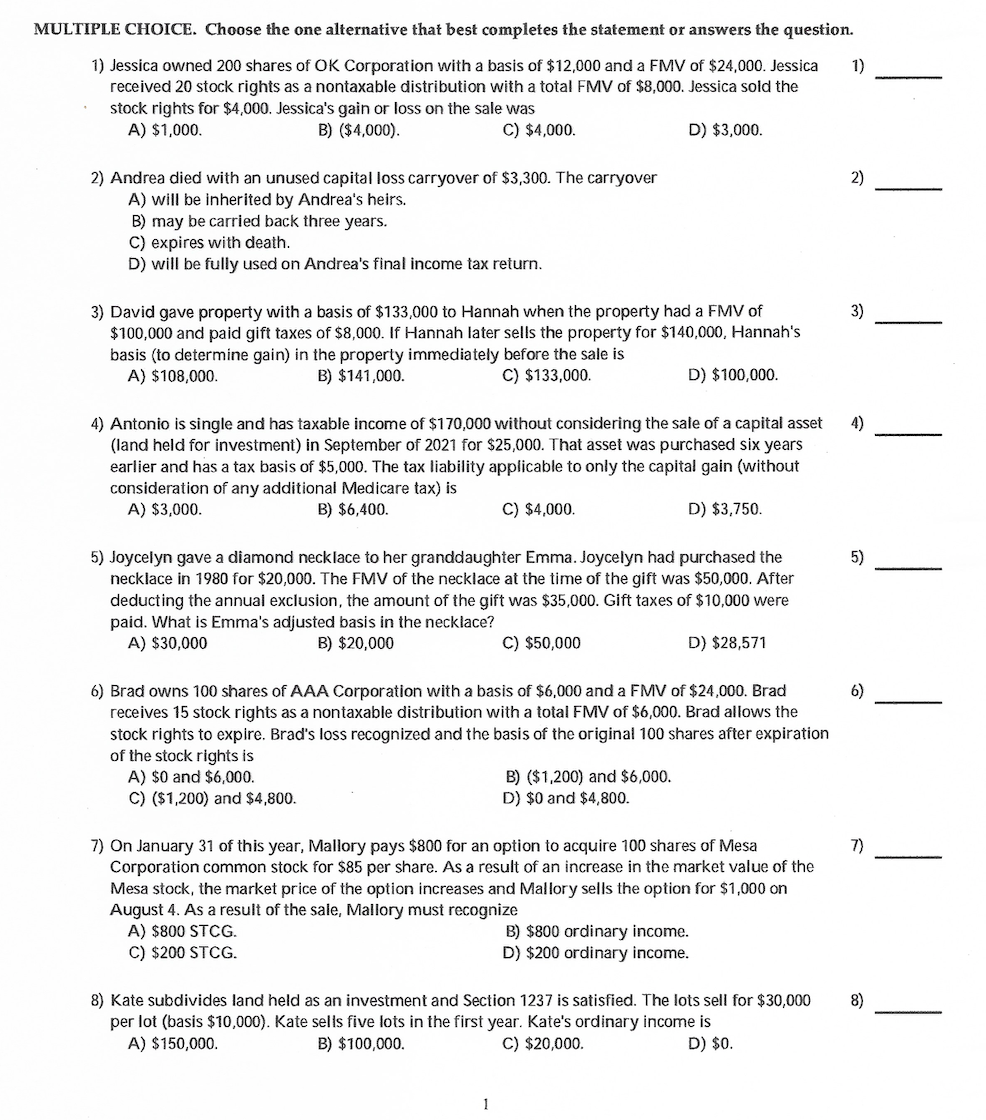

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 1) Jessica owned 200 shares of OK Corporation with a basis of $12,000 and a FMV of $24,000. Jessica 1) received 20 stock rights as a nontaxabie distribution with a total FMV of $0,000. Jessica sold the \"' stock rights for $4,000. Jessica's gain or loss on the sale was A) $1,000. B) ($4,000). C} $4,000. D) $3,000. 2} Andrea died with an unused capital loss carryover of $3,300. T he carryover 2} A) will be inherited by Andrea's heirs. B) may be carried back three years. C) expires with death. D) will be fully used on Andrea's final Income tax return. 3) David gave property with a basis of $133,000 to Hannah when the property had a FMV of 3) $100,000 and paid gift taxes of $8.000. If Hannah later sells the property for $140000. Hannah's basis (to determine gain) in the property immediately before the sale is A) $108,000. B) $141,000. C} $133,000. D} $100,000. 4) Antonio is single and has taxable income of $1 i0.000 without considering the sale of a capital asset 4) {land held for investment) in September of 2021 for $25 .000. That asset was purchased six years earlier and has a tax basis of $5,000. The tax liability applicable to only the capital gain (without consideration of any additional Medicare la x) is A) $3,000. B) $6,400. C) $4,000. 0) $3,750. 5) Joycelyn gave a diamond necklace to her granddaughter Emma. loyceiyn had purchased the 5} necklace in 1900 for $20,000. The FMV of the necklace at the time of the gift was $50,000. After deducting the annual exclusion, the amount of the gift was $35,000. Gift taxes of $10,000 were paid. What is Emma's adjusted basis In the necklace? A) $30,000 8} 520,000 C} $50,000 D) $28,571 6) Brad owns 100 shares otAAA Corporation with a basis of $6.000 and 3 FW of $24,000. Brad 6) receives 15 stock rights as a nontaxable distribution with a total FMV of $6,000. Brad allows the stock rights to expire. Brad's loss recognized and the basisot the original 100 shares after expiration of the stock rights Is A) $0 and $6.000. B} {$1.200} and $6,000. 6) (51,200) and $4,300. ' D) so and $4,000. 7) On January 31 of this year, Mallory pays $800 for an option to acquire 100 shares of Mesa 7) Corporation common stock for $35 per share. As a result of an Increase in the market value of the Mesa stock, the market price of the option increases and Mallory sells the option for $1,000 on August 4. As a result of the sale. Mallory must recognize A) $800 STCG. B} 5800 ordinary income. C) $200 STCG. D) 5200 ordinary income. 3) Kate subdivides land held as an investment and Section 1237 is satised. The lots sail for $30,000 8) per lot {basis $10,000). Kate sells five lots in the first year. Kate's ordinary income is A) $150,000. 3) $100,000. C) $20,000. D) $0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts