Question: Multiple Choice: i Theresa is currently evaluating two mutually exclusive projects which have the following after-tax net cash flows. Both projects have a cost of

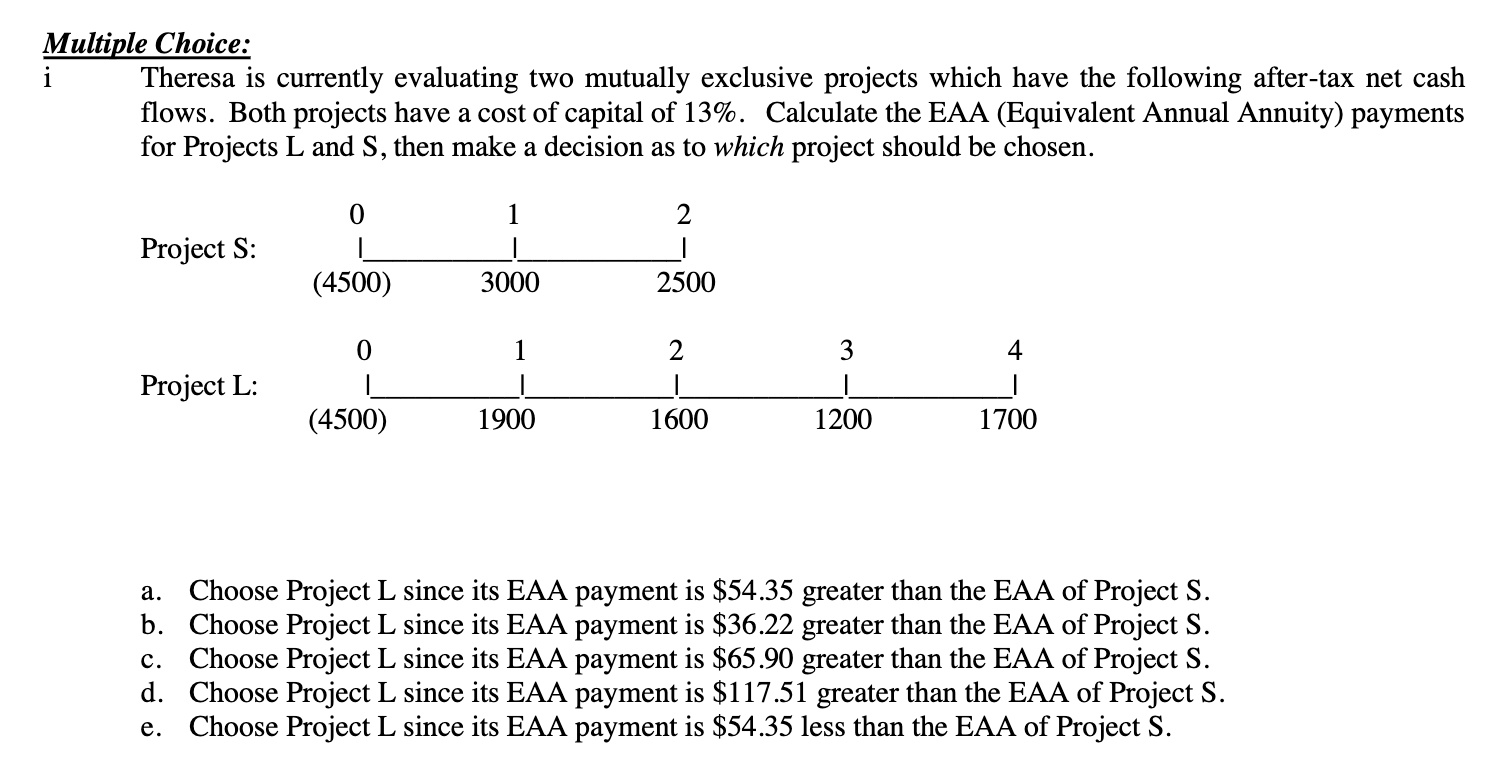

Multiple Choice: i Theresa is currently evaluating two mutually exclusive projects which have the following after-tax net cash flows. Both projects have a cost of capital of 13%. Calculate the EAA (Equivalent Annual Annuity) payments for Projects L and S, then make a decision as to which project should be chosen. 0 1 2 Project S: (4500) 3000 2500 0 1 2 3 4 Project L: (4500) 1900 1600 1200 1700 a. Choose Project L since its EAA payment is $54.35 greater than the EAA of Project S. b. Choose Project L since its EAA payment is $36.22 greater than the EAA of Project S. c. Choose Project L since its EAA payment is $65.90 greater than the EAA of Project S. d. Choose Project L since its EAA payment is $117.51 greater than the EAA of Project S. Choose Project L since its EAA payment is $54.35 less than the EAA of Project S. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts