Question: Multiple Choice Iddurify inse ohotce shat best completes the statement or answers the question. Expected Price of a Stock at Constant Growth. You ano evaluating

Multiple Choice

Iddurify inse ohotce shat best completes the statement or answers the question.

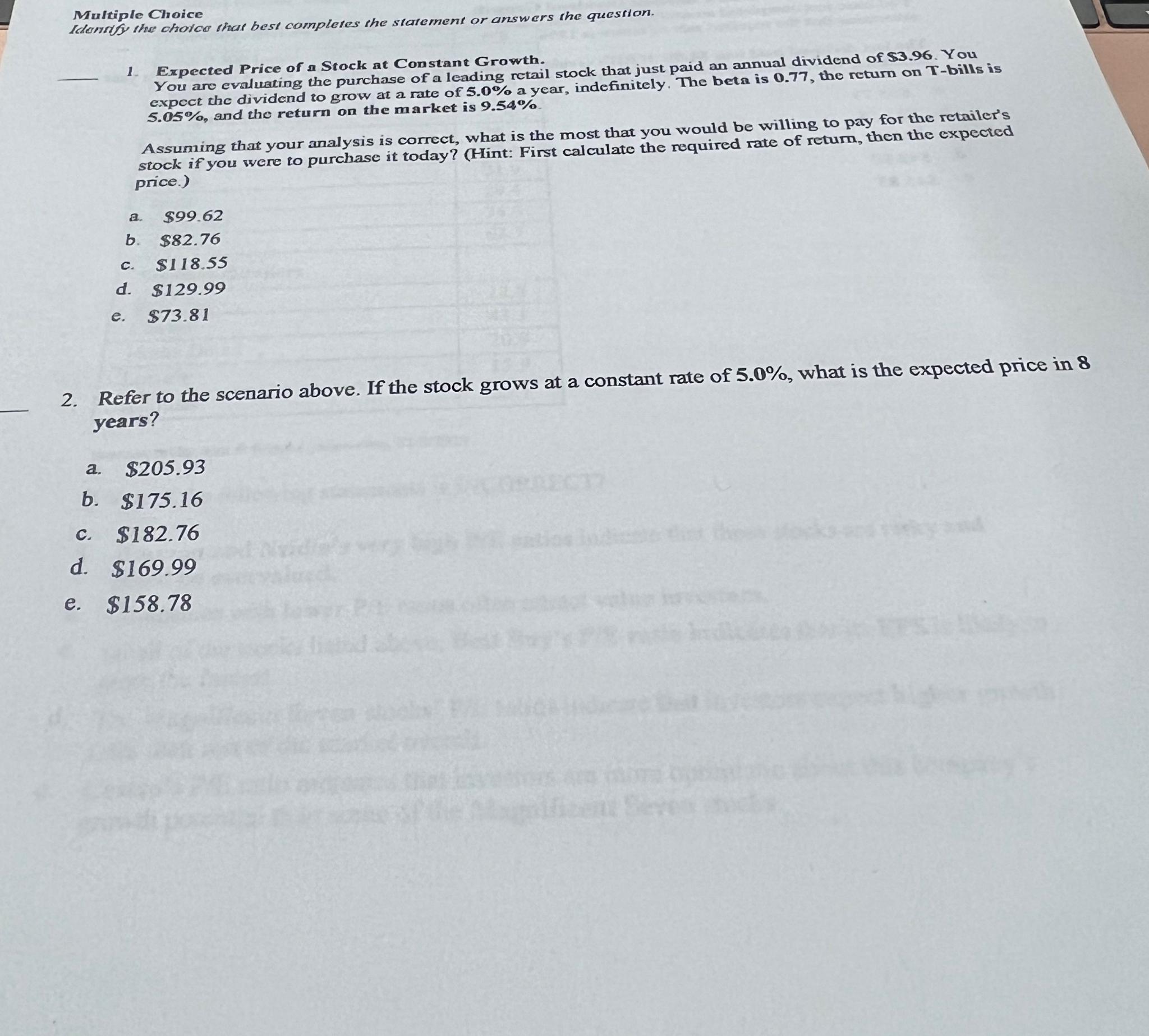

Expected Price of a Stock at Constant Growth.

You ano evaluating the purchase of a leadiag retail stock that just paid an annual dividend of $ You expect the dividend to grow at a rate of a year, indefinitely. The beta is the return on bills is and the return on the market is

Assurning that your analysis is correct, what is the most that you would be willing to pay for the retailer's stock if you were ro purchase it today? Hint: First calculate the required rate of return, then the expected price.

a $

b $

c $

d $

e $

Refer to the scenario above. If the stock grows at a constant rate of what is the expected price in years?

a $

b $

c $

d $

e $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock