Question: Multiple Choice Identify the choice that best completes the statement or answers the question 1. Which of the following is typically associated with cookie jar

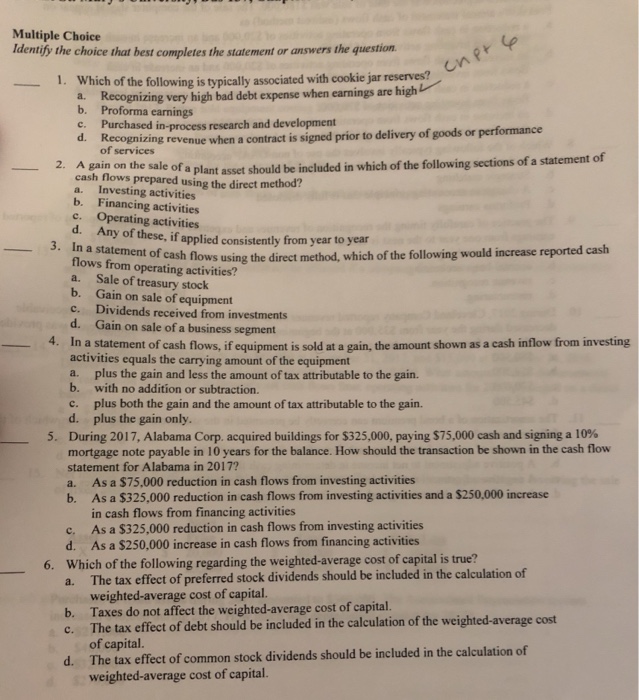

Multiple Choice Identify the choice that best completes the statement or answers the question 1. Which of the following is typically associated with cookie jar reserves? a. Recognizing very high bad debt expense when earnings are high b. Proforma earnings Purchased in-process research and development Recognizi of services c. d. ng revenue when a contract is signed prior to delivery of goods or performance A gain on the sale of a cash flows a. Investing activities b. Financing activities c. Operating activities 2. lant asset should be included in which of the following sections of a statement of should be prepared using the direct method? d. Any of these, if applied consistently from year to year om opeash ows using the direct method, which of the following would increase reported a. b. c. d. Sale of treasury stock Gain on sale of equipment Dividends received from investments Gain on sale of a business segment 4. In a statement of cash flows, if equipment is sold at a gain, the amount shown as a cash inflow from investing activities equals the carrying amount of the equipment a. plus the gain and less the amount of tax attributable to the gain. b. with no addition or subtraction c. plus both the gain and the amount of tax attributable to the gain. d. plus the gain only. During 2017, Alabama Corp. acquired buildings for $325,000, paying $75,000 cash and signing a 10% mortgage note payable in 10 years for the balance. How should the transaction be shown in the cash flow statement for Alabama in 2017? a. As a $75,000 reduction in cash flows from investing activities b. As a $325,000 reduction in cash flows from investing activities and a $250,000 increase 5. in cash flows from financing activities As a $325,000 reduction in cash flows from investing activities As a $250,000 increase in cash flows from financing activities c. d. Which of the following regarding the weighted-average cost of capital is true? a 6. The tax effect of preferred stock dividends should be included in the calculation of weighted-average cost of capital. Taxes do not affect the weighted-average cost of capital. The tax effect of debt should be included in the calculation of the weighted-average cost of capital The tax effect of common stock dividends should be included in the calculation of weighted-average cost of capital b. c. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts