Question: Multiple Choice Interest payments paid to U . S . Treasury bondholders are not taxed at the federal level. Interest payments paid to corporate bondholders

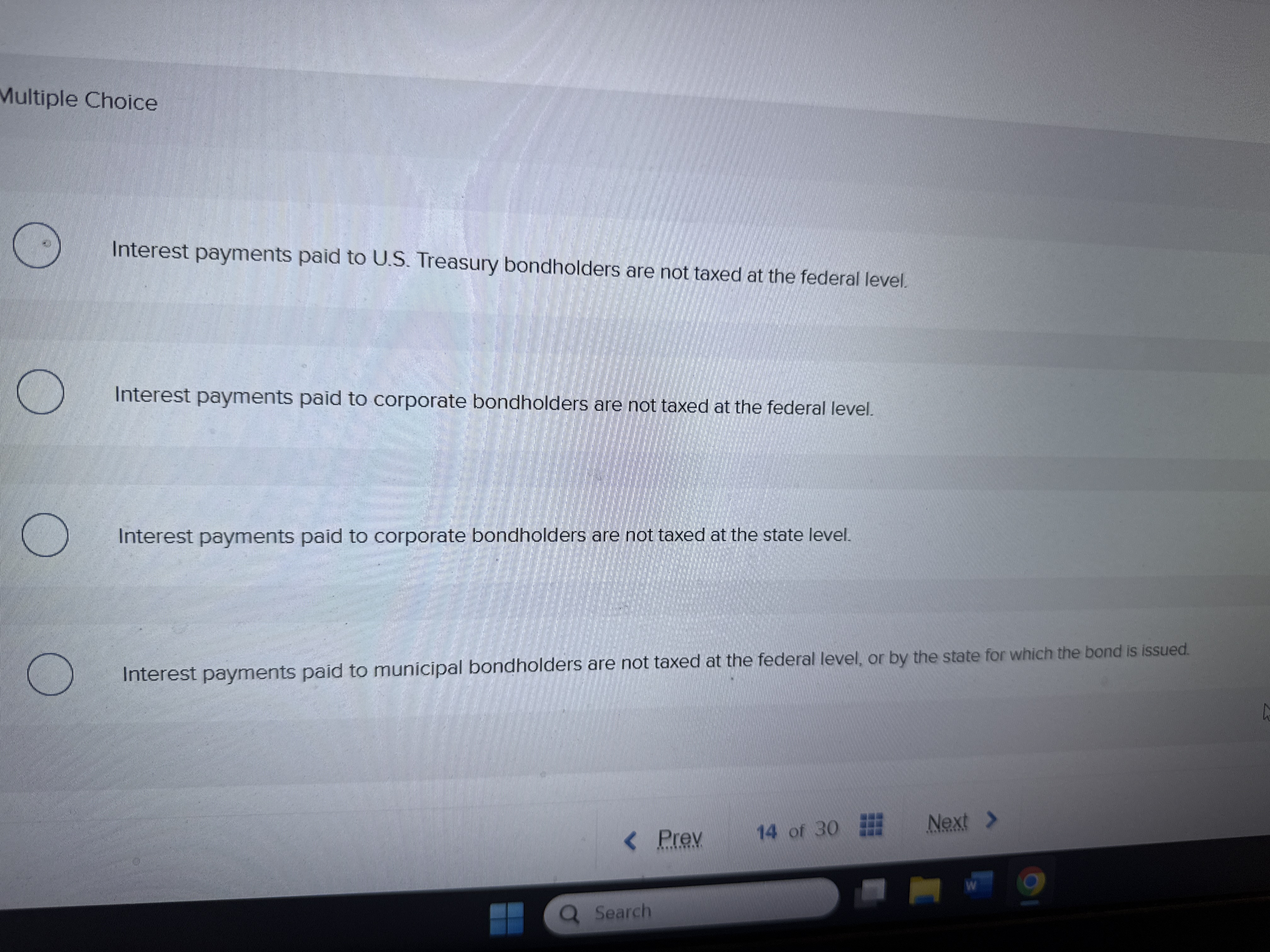

Multiple Choice

Interest payments paid to US Treasury bondholders are not taxed at the federal level.

Interest payments paid to corporate bondholders are not taxed at the federal level.

Interest payments paid to corporate bondholders are not taxed at the state level.

Interest payments paid to municipal bondholders are not taxed at the federal level, or by the state for which the bond is issued.

Prev

of

Next

Search

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock