Question: multiple choice: q5: q6: q7: Current Attempt in Progress Barr Compary acquires 80,10%,5 year, 1,000 Community bonds on January 1,2020 for 680,000. Assume Community pays

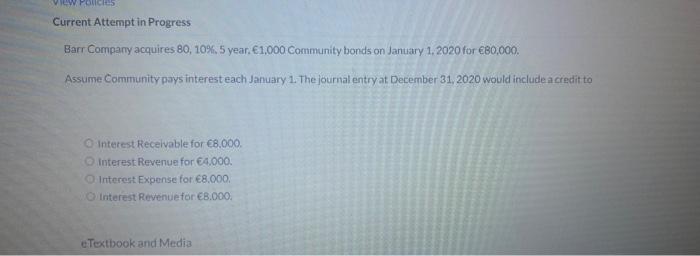

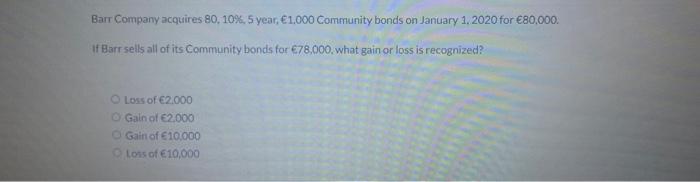

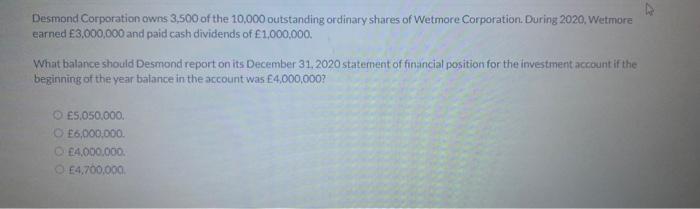

Current Attempt in Progress Barr Compary acquires 80,10%,5 year, 1,000 Community bonds on January 1,2020 for 680,000. Assume Community pays interest each January 1. The journal entry at December 31,2020 would include a credit to Interest Recelvable for {8.000 interest Revenue for 64.000. Interest Expense for 68.000; Interest Revenuefor 8.000. Barr Company acquires 80,10%,5 year, 1.000 Community bonds on January 1,2020 for 80,000. If Barr sells all of its Community bonds for 78,000. what gain or loss is recognized? Loss of 62.000 Gain of 62.000 Gain of 10,000 tors of 10,000 Desmond Corporation cwns 3,500 of the 10,000 outstanding ordinary shares of Wetmore Corporation. During 2020, Wetmore earned 3,000,000 and paid cash dividends of 1,000,000. What balance should Desmond report on its December 31,2020 statement of financial position for the investment account if the beginning of the year batance in the account was E4,000,000 ? E5.050.000, E6,000,000. E4,000,000. E4,700,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts