Question: multiple choice question 1. If you decide to start a long-term investment portfolio which provides steady stream of dividend income, you would be looking for

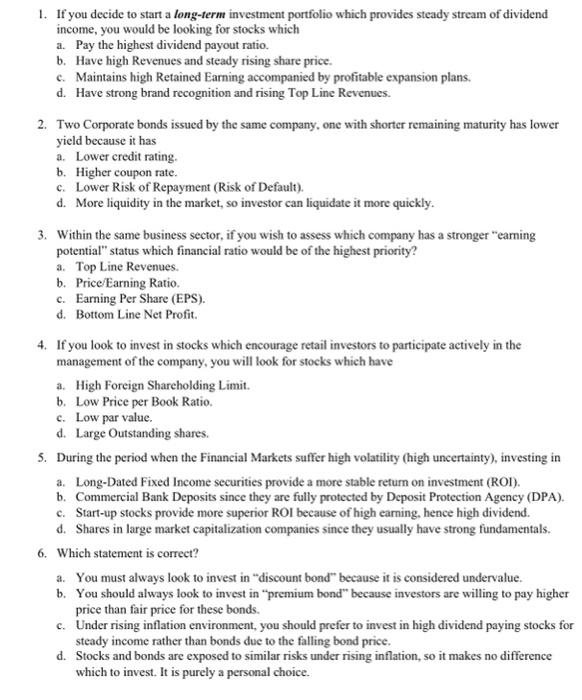

1. If you decide to start a long-term investment portfolio which provides steady stream of dividend income, you would be looking for stocks which a. Pay the highest dividend payout ratio. b. Have high Revenues and steady rising share price. c. Maintains high Retained Earning accompanied by profitable expansion plans. d. Have strong brand recognition and rising Top Line Revenues. 2. Two Corporate bonds issued by the same company, one with shorter remaining maturity has lower yield because it has . Lower credit rating b. Higher coupon rate. c. Lower Risk of Repayment (Risk of Default). d. More liquidity in the market, so investor can liquidate it more quickly. 3. Within the same business sector, if you wish to assess which company has a stronger "earning potential" status which financial ratio would be of the highest priority? a. Top Line Revenues. b. Price/Earning Ratio. c. Earning Per Share (EPS). d. Bottom Line Net Profit 4. If you look to invest in stocks which encourage retail investors to participate actively in the management of the company, you will look for stocks which have 2. High Foreign Shareholding Limit. b. Low Price per Book Ratio. c. Low par value. d. Large Outstanding shares. 5. During the period when the Financial Markets suffer high volatility (high uncertainty), investing in a. Long-Dated Fixed Income securities provide a more stable return on investment (ROI). b. Commercial Bank Deposits since they are fully protected by Deposit Protection Agency (DPA). c. Start-up stocks provide more superior ROI because of high earning, hence high dividend. d. Shares in large market capitalization companies since they usually have strong fundamentals. 6. Which statement is correct? a. You must always look to invest in "discount bond" because it is considered undervalue. b. You should always look to invest in "premium bond" because investors are willing to pay higher price than fair price for these bonds. c. Under rising inflation environment, you should prefer to invest in high dividend paying stocks for steady income rather than bonds due to the falling bond price. d. Stocks and bonds are exposed to similar risks under rising inflation, so it makes no difference which to invest. It is purely a personal choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts