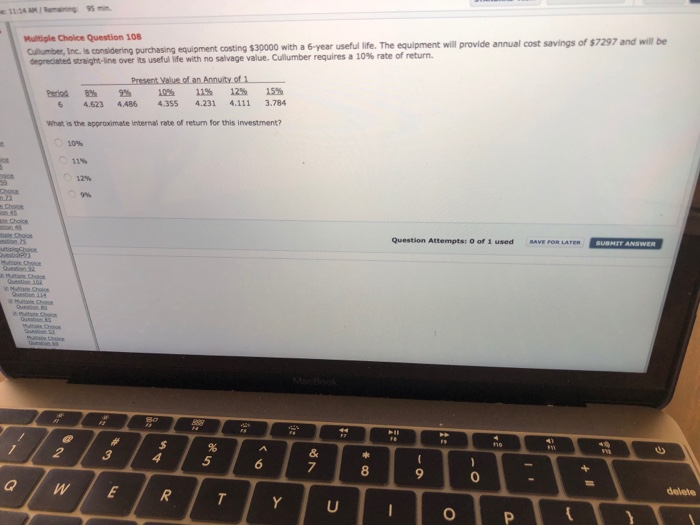

Question: Multiple Choice Question 108 Ohumber, Inc. is considering purchasing equipment costing $30000 with a 6-year useful life. The equipment will provide annual cost savings of

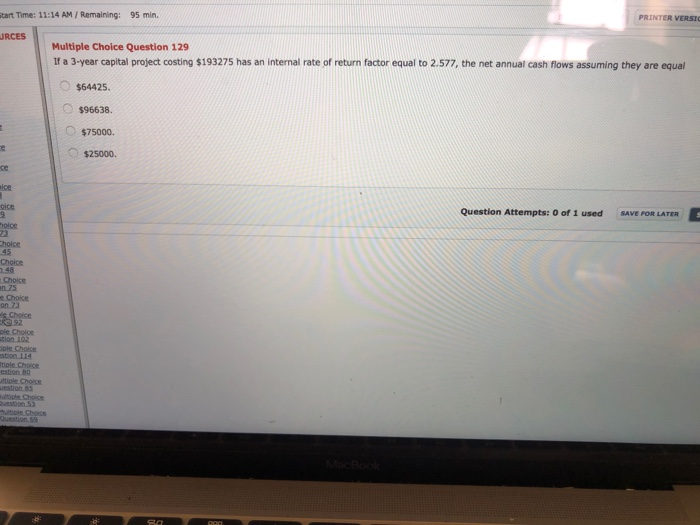

Multiple Choice Question 108 Ohumber, Inc. is considering purchasing equipment costing $30000 with a 6-year useful life. The equipment will provide annual cost savings of $7297 and will be deprecated straight-line over its useful life with no salvage value. Cullumber requires a 10% rate of return Present Value of an Annuity of 1 119 12% 15% 4.623 4.486 4.355 4.231 4.111 3.784 What is the approximate internal rate of return for this investment? 10% 12% Question Attempts: 0 of 1 used SAVE FOR LATER SUBMIT ANSWER ho . FB 110 a w $ 4 3 % 5 & 7 C - 6 8 9 O W E R delete T Y U - o tart Time: 11:14 AM / Remaining: 95 min. PRINTER VERSIC URCES Multiple Choice Question 129 If a 3-year capital project costing $193275 has an internal rate of return factor equal to 2.577, the net annual cash flows assuming they are equal $64425. $96638 $75000. $25000 ice Question Attempts: 0 of 1 used SAVE FOR LATER hoice Choice 45 Choice Choice an 75 Choice on 73 ole Choice tion 102 ole Choice stion 114 Tile Choice estion 10 tiple Choice westions Joe Choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts