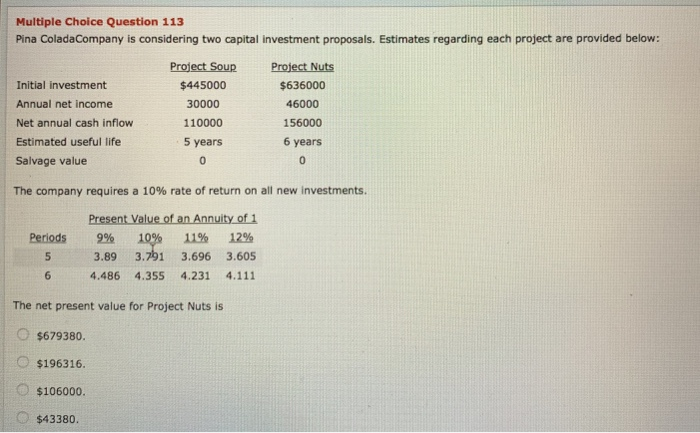

Question: Multiple Choice Question 113 Pina ColadaCompany is considering two capital investment proposals. Estimates regarding each project are provided below: Profect Soup Proect Nuts Initial investment

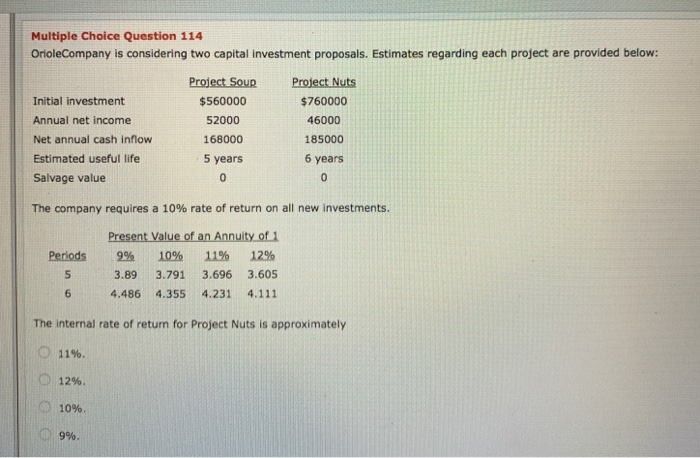

Multiple Choice Question 113 Pina ColadaCompany is considering two capital investment proposals. Estimates regarding each project are provided below: Profect Soup Proect Nuts Initial investment Annual net income Net annual cash inflow Estimated useful life Salvage value $445000 30000 110000 5 years 0 $636000 46000 156000 6 years 0 The company requires a 10% rate of return on all new investments. Periods 99 5 3.89 3.791 3.696 3.605 6 4.486 4.355 4.231 4.111 The net present value for Project Nuts is O $679380. O$196316 $106000 $43380 Multiple Choice Question 114 OrioleCompany is considering two capital investment proposals. Estimates regarding each project are provided below: $560000 52000 168000 5 years 0 $760000 46000 185000 6 years Initial investment Annual net income Net annual cash inflow Estimated useful life Salvage value The company requires a 10% rate of return on all new investments. n Annuity of 1 Periods 996 10% 11% 12% 3.89 3.791 3.696 3.605 4.486 4.355 4.231 4.111 The internal rate of return for Project Nuts is approximately O 11% 12% ) 1096. 9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts