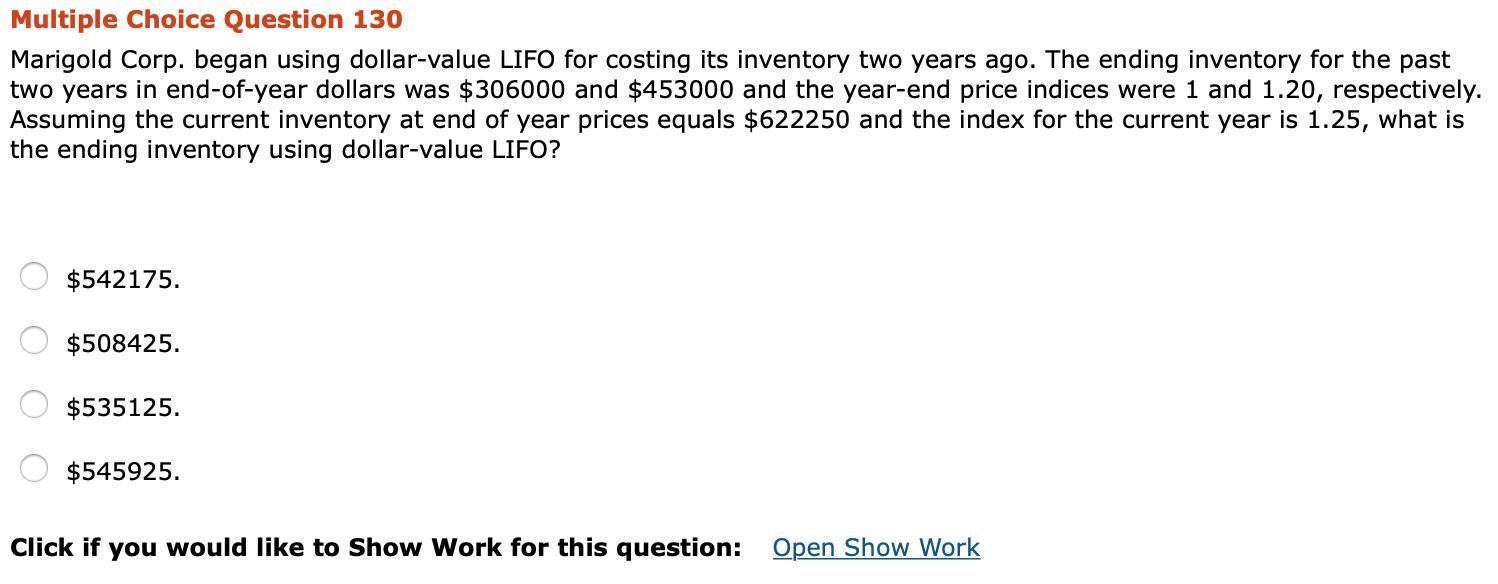

Question: Multiple Choice Question 130 Marigold Corp. began using dollar-value LIFO for costing its inventory two years ago. The ending inventory for the past two years

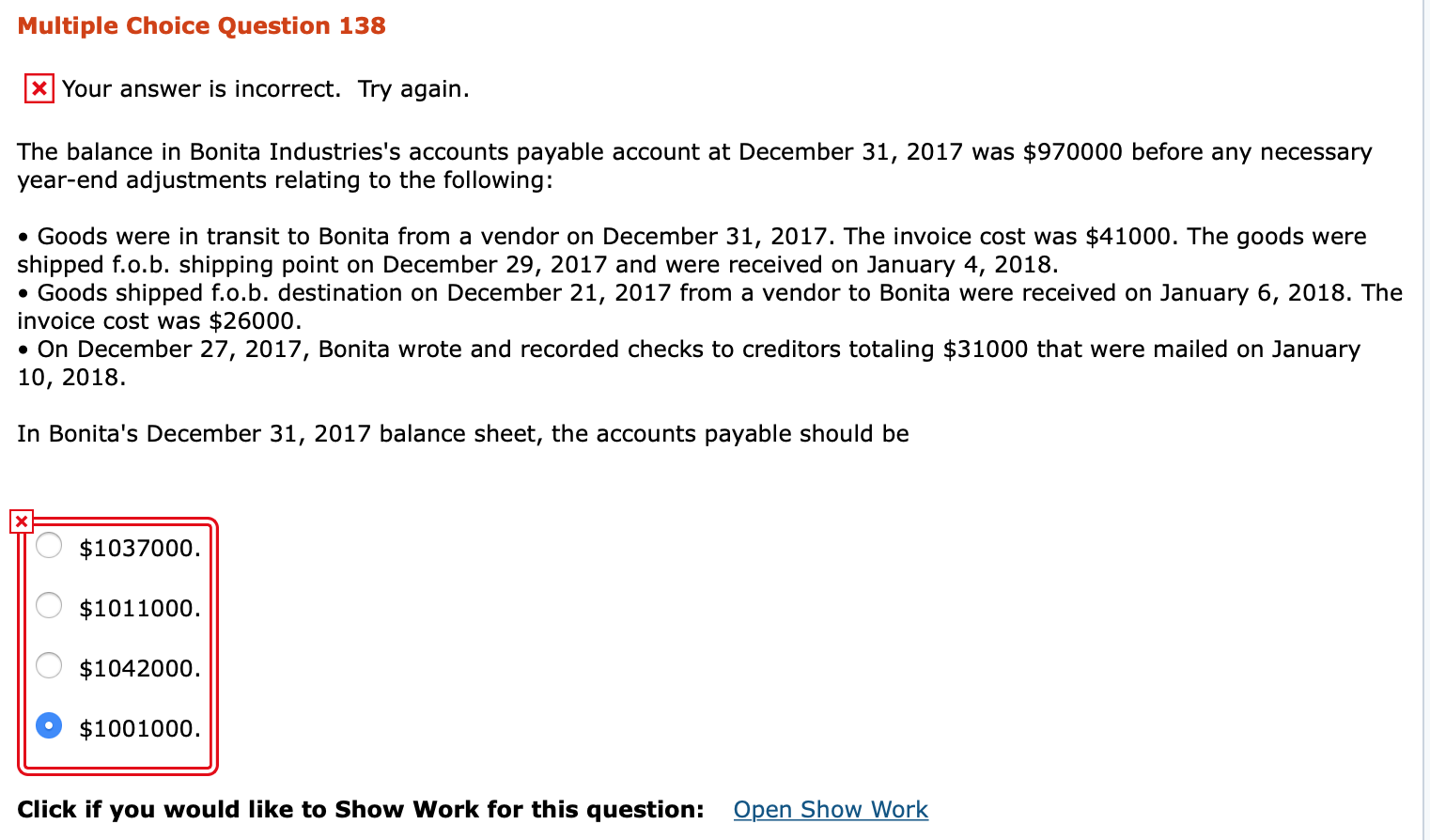

Multiple Choice Question 130 Marigold Corp. began using dollar-value LIFO for costing its inventory two years ago. The ending inventory for the past two years in end-of-year dollars was $306000 and $453000 and the year-end price indices were 1 and 1.20, respectively. Assuming the current inventory at end of year prices equals $622250 and the index for the current year is 1.25, what is the ending inventory using dollar-value LIFO? $542175. $508425. $535125. $545925. Click if you would like to Show Work for this question: Open Show Work Multiple Choice Question 138 * Your answer is incorrect. Try again. The balance in Bonita Industries's accounts payable account at December 31, 2017 was $970000 before any necessary year-end adjustments relating to the following: Goods were in transit to Bonita from a vendor on December 31, 2017. The invoice cost was $41000. The goods were shipped f.o.b. shipping point on December 29, 2017 and were received on January 4, 2018. Goods shipped f.o.b. destination on December 21, 2017 from a vendor to Bonita were received on January 6, 2018. The invoice cost was $26000. On December 27, 2017, Bonita wrote and recorded checks to creditors totaling $31000 that were mailed on January 10, 2018. In Bonita's December 31, 2017 balance sheet, the accounts payable should be $1037000. $1011000. $1042000. $1001000. Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts