Question: Multiple Choice Question 133 Bramblehas a standard of 2 hours of labor per unit, at $12 per hour. In producing 3200 units, Bramble used 6100

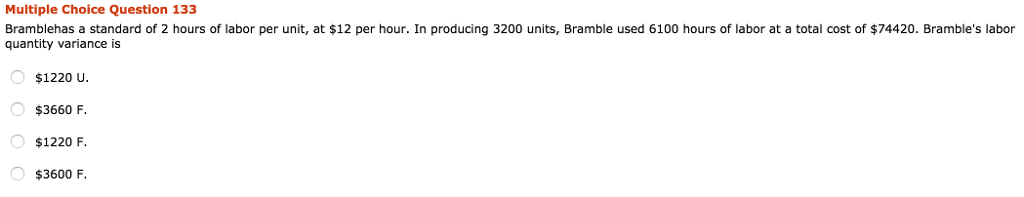

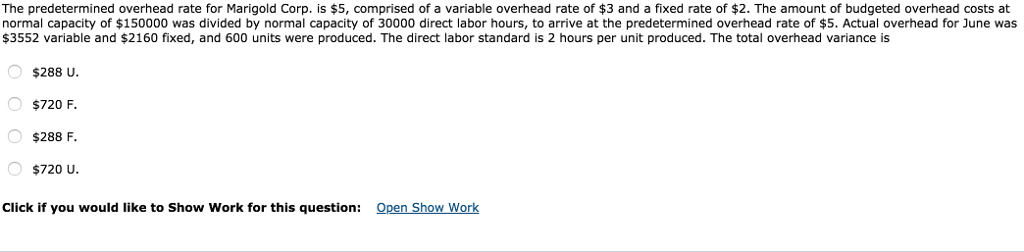

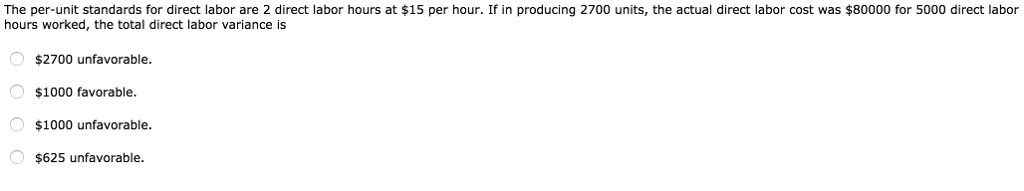

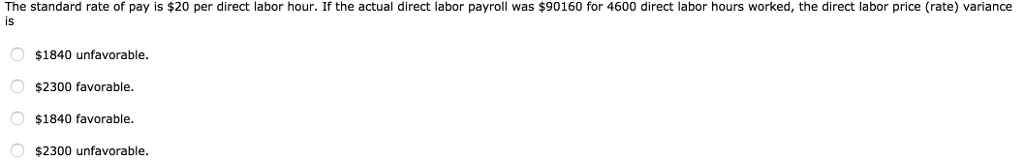

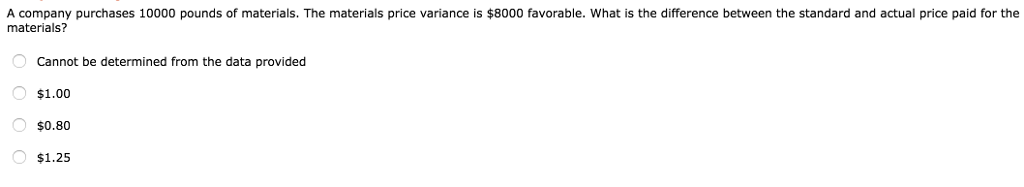

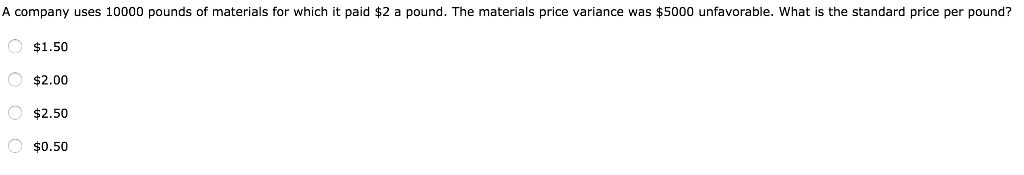

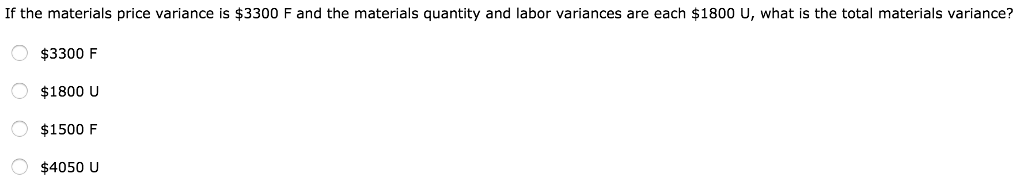

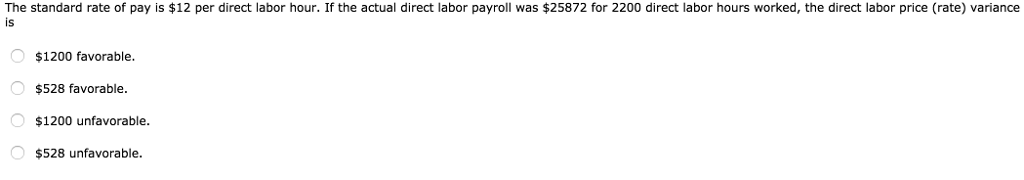

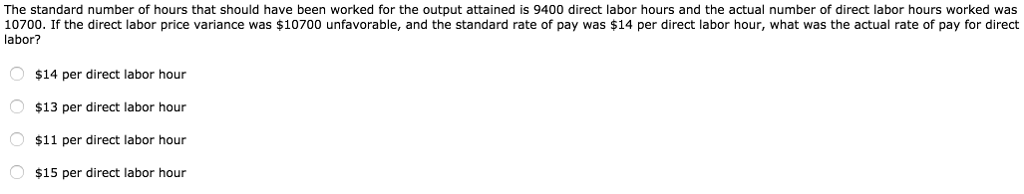

Multiple Choice Question 133 Bramblehas a standard of 2 hours of labor per unit, at $12 per hour. In producing 3200 units, Bramble used 6100 hours of labor at a total cost of $74420. Bramble's labor quantity variance is $1220 U $3660 F $1220 F. $3600 F The predetermined overhead rate for Marigold Corp. is $5, comprised of a variable overhead rate of $3 and a fixed rate of $2. The amount of budgeted overhead costs at normal capacity of $150000 was divided by normal capacity of 30000 direct labor hours, to arrive at the predetermined overhead rate of $5. Actual overhead for June was $3552 variable and $2160 fixed, and 600 units were produced. The direct labor standard is 2 hours per unit produced. The total overhead variance is $288 U $720 F. $288 F. $720 U Click if you would like to Show Work for this question: Open Show Work The per-unit standards for direct labor are 2 direct labor hours at $15 per hour. If in producing 2700 units, the actual direct labor cost was $80000 for 5000 direct labor hours worked, the total direct labor variance is $2700 unfavorable. $1000 favorable. $1000 unfavorable. $625 unfavorable. The standard rate of pay is $20 per direct labor hour. If the actual direct labor payroll was $90160 for 4600 direct labor hours worked, the direct labor price (rate) variance is $1840 unfavorable $2300 favorable $1840 favorable $2300 unfavorable A company purchases 10000 pounds of materials. The materials price variance is $8000 favorable. What is the difference between the standard and actual price paid for the materials? Cannot be determined from the data provided $1.00 $0.80 $1.25 A company uses 10000 pounds of materials for which it paid $2 a pound. The materials price variance was $5000 unfavorable, what is the standard price per pound? $1.50 $2.00 $2.50 $0.50 If the materials price variance is $3300 F and the materials quantity and labor variances are each $1800 U, what is the total materials variance? $3300 F $1800 U $1500 F $4050 U The standard rate of pay is $12 per direct labor hour. If the actual direct labor payroll was $25872 for 2200 direct labor hours worked, the direct labor price (rate) variance is $1200 favorable $528 favorable $1200 unfavorable $528 unfavorable. The standard number of hours that should have been worked for the output attained is 9400 direct labor hours and the actual number of direct labor hours worked was labor? 10700. If the direct labor price variance was $10700 unfavorable, and the standard rate of pay was $14 per direct labor hour, what was the actual rate of pay for direct $14 per direct labor hour $13 per direct labor hour $11 per direct labor hour $15 per direct labor hour

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts