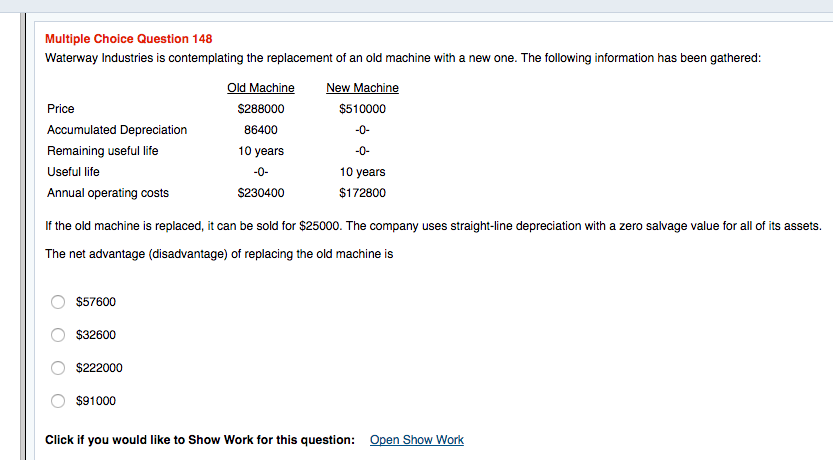

Question: Multiple Choice Question 148 Waterway Industries is contemplating the replacement of an old machine with a new one. The following information has been gathered: Old

Multiple Choice Question 148 Waterway Industries is contemplating the replacement of an old machine with a new one. The following information has been gathered: Old Machine S288000 86400 10 years New Machine $510000 Tix Accumulated Depreciation Remaining useful life Useful life Annual operating costs 10 years $172800 If the old machine is replaced, it can be sold for $25000. The company uses straight-line depreciation with a zero salvage value for all of its assets. The net advantage (disadvantage) of replacing the old machine is O $57600 $32600 $222000 O S91000 Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts