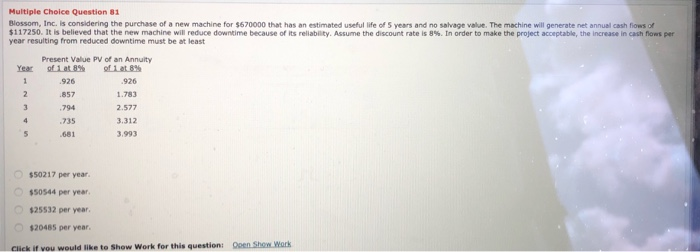

Question: Multiple Choice Question 31 Blossom, Inc. is considering the purchase of a new machine for $670000 that has an estimated us e of years and

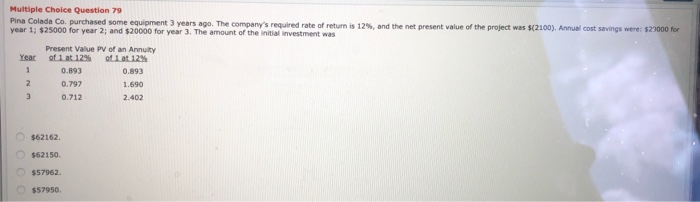

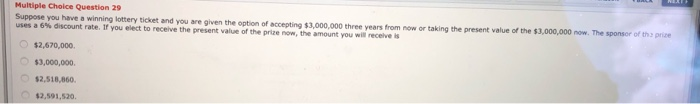

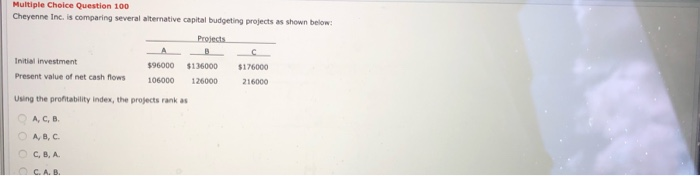

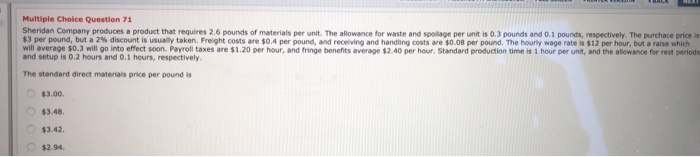

Multiple Choice Question 31 Blossom, Inc. is considering the purchase of a new machine for $670000 that has an estimated us e of years and $117250. It is believed that the new machine will reduce downtime because of its reability. Assume the discount rates year resulting from reduced downtime must be at least salvage value. The machine will generate netannual cash flows in order to make the project acceptable, the increase in cash flows per Yea Present Value PV of an Annuity 1 at 8% 0 926 926 857 794 2.577 3.312 681 3.993 $50217 per year $50544 per year. $25532 per year. 520485 per year. yes would like to show Work for this questioni on Show Work Multiple Choice Question 79 Pina Colada Co purchased some equipment 3 years ago. The company's required rate of return is 12 year 1: $25000 for year 2, and $20000 for year. The amount of the initial investment was and the net present value of the project was $2100). Annual cost savings were: $23000 for Year Present Value PV of an Annuity of 12 12 0.893 0.93 0.797 0.712 $62162 $62150 $57962 $57950 Multiple Choice Question 29 Suppose you have a winning lottery ticket and you are given the option of accepting $3,000,000 three years from now or taking the present value of the $3.000.000 now. The sponsor of th uses a 6% discount rate. If you elect to receive the present value of the prize now, the amount you will receives e $2,670,000 $3.000.000 $2.518,660 Multiple Choice Question 100 Cheyenne Inc. is comparing several alternative capital budgeting projects as shown below: Projects Initial investment Present value of net cash flows $96000 106000 $136000 126000 $176000 216000 Using the profitability Index, the projects rankas A,C,B. O A,B,C. C.B.A. Multiple Choice Question 71 Sheridan Company produces a product that requires 2.6 pounds of materials per unit. The allowance for waste and spolage per unit is 0.3 pounds and 0.1 pounds, respectively. The purchase price $3 per pound, but a 2% discount is usually taken Freight costs are $0.4 per pound, and receiving and handling costs are $0.08 per pound. The hourly wage rate is $12 per hour, but a raise which will average 0.3 will go into effect soon. Payroll taxes are $1.20 per hour, and fringe benefits average $2.40 per hour. Standard production time is 1 hour per unit, and the allowance for rest periode and setup is 0.2 hours and 0.1 hours, respectively The standard direct material price per pound is 3.00 $3.42 $2.94

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts