Question: Multiple Choice Question 65 Your answer is incorrect. Try again. Carla Vista Corporation prepared the following reconciliation for its first year of operations: Pretax financial

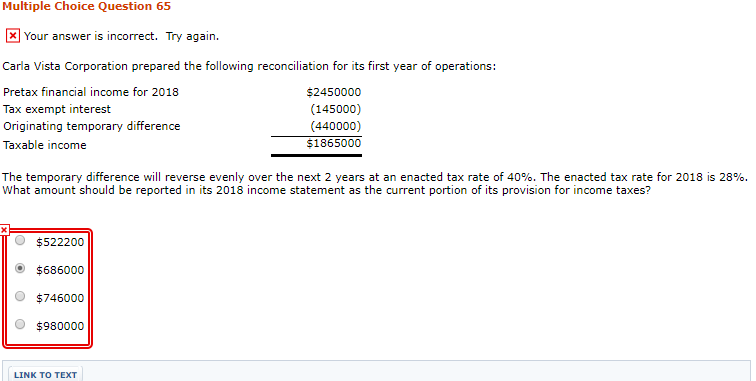

Multiple Choice Question 65 Your answer is incorrect. Try again. Carla Vista Corporation prepared the following reconciliation for its first year of operations: Pretax financial income for 2018 Tax exempt interest Originating temporary difference Taxable income $2450000 (145000) (440000) $1865000 The temporary difference will reverse evenly over the next 2 years at an enacted tax rate of 40%. The enacted tax rate for 2018 is 28%. What amount should be reported in its 2018 income statement as the current portion of its provision for income taxes? $522200 $686000 O $746000 O $980000 LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts