Question: Multiple Choice Question 70 Crane, Inc. leased equipment from Tower Company under a 4-year lease requiring equal annual payments of $454152, with the first payment

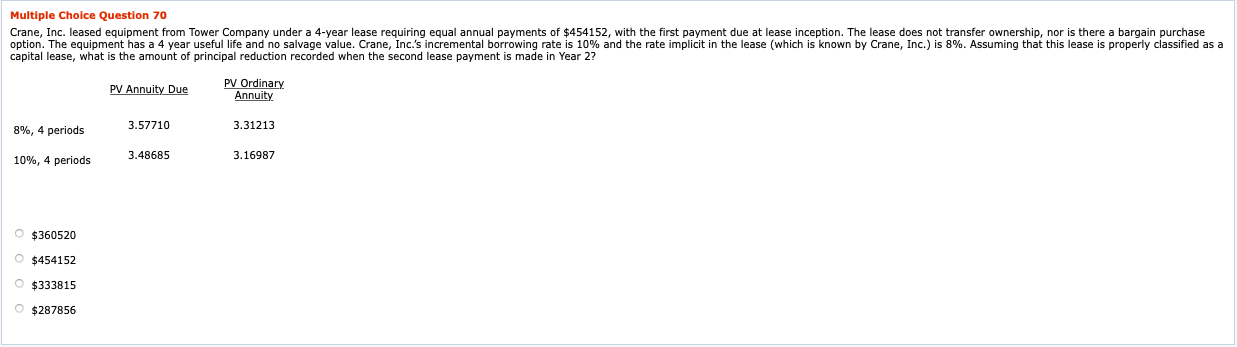

Multiple Choice Question 70 Crane, Inc. leased equipment from Tower Company under a 4-year lease requiring equal annual payments of $454152, with the first payment due at lease inception. The lease does not transfer ownership, nor is there a bargain purchase option. The equipment has a 4 year useful life and no salvage value. Crane, Inc.'s incremental borrowing rate is 10% and the rate implicit in the lease (which is known by Crane, Inc.) is 8%. Assuming that this lease is properly classified as a capital lease, what is the amount of principal reduction recorded when the second lease payment is made in Year 2? PV Annuity Due PV Ordinary Annuity 8%, 4 periods 3.57710 3.31213 3.48685 3.16987 10%, 4 periods $360520 $454152 $333815 $287856

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts