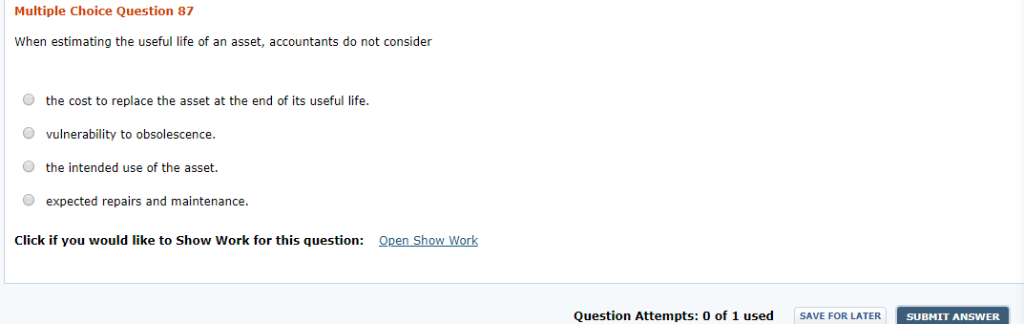

Question: Multiple Choice Question 87 When estimating the useful life f an asset, accountants do not consider O the cost to replace the asset at the

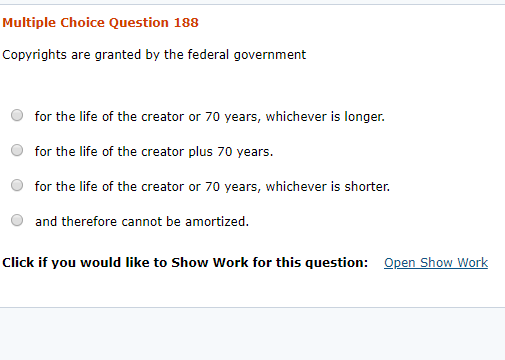

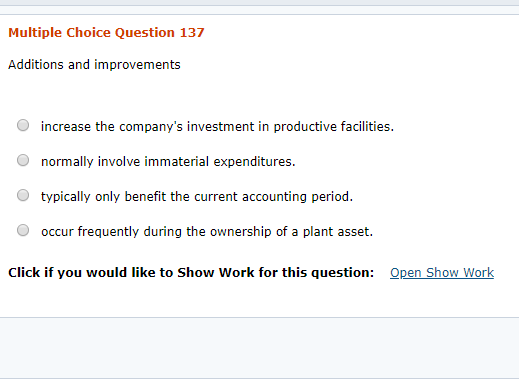

Multiple Choice Question 87 When estimating the useful life f an asset, accountants do not consider O the cost to replace the asset at the end of its useful life. vulnerability to obsolescence. the intended use of the asset expected repairs and maintenance. Click if you would like to Show Work for this question: Open Show Work Question Attempts: 0 of 1 used SAVE FOR LATER SUBMIT ANSWER Multiple Choice Question 188 Copyrights are granted by the federal government for the life of the creator or 70 years, whichever is longer. for the life of the creator plus 70 years. for the life of the creator or 70 years, whichever is shorter. and therefore cannot be amortized. Open Show Work click if you would like to Show Work for this question: Multiple Choice Question 137 Additions and improvements increase the company's investment in productive facilities. normally involve immaterial expenditures. typically only benefit the current accounting period. occur frequently during the ownership of a plant asset Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts